Passive Income on Algorand

Passive income is like the holy grail or the fountain of youth, it feels like everyone is constantly in pursuit of it. In reality, most passive income opportunities are either inaccessible or not passive at all. Crypto is the one place where you can find accessible sources of passive income, but it does not come without risk (though there are a few ways to get started for free). In this article, we will discuss many of the major available streams of passive income that can be earned on the Algorand Blockchain; their relative risk levels, the % APR/APY you can earn, and how long those streams of income will be viable for. I will share my subjective perspective of the risk and reward, but I do not recommend making any investments under the assumption that something is safe. Take my opinion with a grain of salt. This is crypto, there is inherent risk. If something seems too good to be true, be wary. No one knows what will happen (see Anchor Protocol). This is not financial advice.

Disclaimer: Investing in cryptocurrency is risky. Investing in assets on specific blockchains is even riskier. Please consider your risk tolerance levels when deciding whether or not to take up one of these streams. The purpose of this article to is to increase awareness of projects, not to convince anyone to invest. Not financial advice, do your own research!

Table of Contents

Algorand Governance

Providing Liquidity on AMMs

Tinyman

Pact.Fi

Staking Protocols on Algorand

Yieldly

AlgoStake

The Algo Faucet

AlgoFi

Lofty AI

Alchemon

Algorand Governance

Algorand’s Governance protocol is the primary way through which decisions about Algorand’s future are made via quarterly voting periods. The protocol requires participants to maintain a committed balance of Algos at the start of each period and vote on measures that are proposed within the Algorand Foundation’s given timeframe. If a participant does not vote or dips beneath their committed stake in their linked wallet they become ineligible for that period’s rewards, which are paid at the end of each period.

Rate (APR%): 8-14% APR. The rate is determined by the period’s ALGO reward divided by the number of committed algos at the end of the period. For period 1, this was 14.05%. For period 2, it was 10.02%1. Period 3 is currently sitting at 7.78%3, but this number is likely to increase as the quarter goes on.

Risk Level Compared to Holding $ALGO (1-10): 1. There is no additional risk to holding Algo as you can remove your committed stake at any time.

Length of time: 2029+

Note: Period 3 of governance has brought out a unique innovation that allows users to use their governance stake as collateral for a loan rather than having it just sit there. There are multiple platforms that offer this service with different reward potentials; so I’ll link to three of the Algorand Governors Club’s articles on how to utilize them:

GARD Strategy Guide

Folks Finance

AlgoFi Vault

Providing Liquidity on AMMs

Tinyman

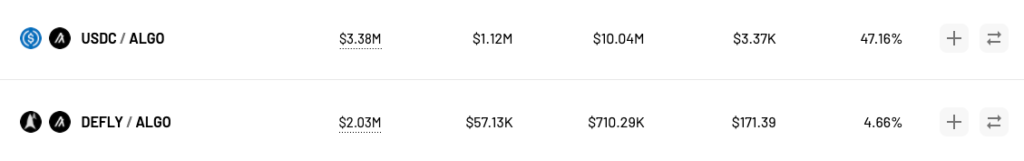

Liquidity providing is a vital element of creating Automated Market Makers such as Tinyman. A user provides liquidity in equal parts of two assets, so that other users can swap between assets. In exchange for providing liquidity, the user receives fees which swappers are charged for each exchange, on Tinyman these fees are 0.25%. As you can imagine, this can get profitable quickly. The most profitable pools are ones that have a high volume exchanged to total value locked ratio, as seen by the analytics page on the Tinyman app.

This makes the risk and profitability of a pool highly dependent on the two assets; their individual stability, and their price correlation to each other. This means that each pool is far different in risk and reward from the next. Conduct thorough analysis before deciding to be a liquidity provider (LP), especially with riskier assets. More information about LP creation on Tinyman and the risks associated can be found here.

Tinyman Liquidity Pools

Rate (APR%): 2 to 100%+. Since each pool’s risks and rewards are so different from the others, it makes the rates extremely variable too. Stablecoin to Stablecoin pairings have very low rates and very low risks. ASA* to ASA pairings can have very high rates and very high risks. If a pool looks too good to be true, it probably is.

Risk Level Compared to Holding $ALGO (1.5-10): Varies from 1.5 to 10. Same logic as above. Stable to Stable is about as safe as it gets on the Algorand Blockchain. An ASA to ASA pool with brand new tokens and 300% APR? Odds are higher than not that your liquidity is about to get rugpulled.

Length of time: As long as Algorand’s DeFi is around, liquidity pools and LP providing will be too.

Tinyman Farms

Rate (APR%): 10 – 28%. Tinyman Farms are a select few pools that have been boosted by the Algorand Foundations Aeneus Rewards with the goal of incentivizing liquidity. They will not last a long time, but while they are up will have a disproportionate risk to reward ratio.

Risk Level Compared to Holding $ALGO: 1.5-2. Before the collapse of Luna/UST, this number may have been a 1. The implosion of the anchor protocol proved that stable-coins hold risk, and so a metric of 1.5 to 2 feels more accurate.

Length of Time: Tinyman’s farm rewards end on August 1st, 2022.

Pact.Fi

Pact.Fi is an AMM that is similar to Tinyman but works with somewhat different mechanics, which you can read about here. There is less liquidity and volume on Pact.Fi than Tinyman, which means that the risk to reward ratios differ somewhat. There are also different pool boosts as a result of the Aeneas rewards, so it is worth comparing between both AMMs to see which is more profitable. You can see a list of Pact.Fi pools here. There are currently very lucrative Aeneas rewards running, but since those will only last another week I did not include them.

*ASA stands for Algorand Standardized Asset

Staking Protocols on Algorand

Yieldly

Yieldly is the first and largest Decentralized Finance suite on Algorand. It is a platform for liquidity mining, no loss prize games, multi-asset staking, and cross-chain swapping.

I’ve already written multiple articles on Yieldly, as it was once the face of passive income on Algorand. These articles include What Yieldly is and how to use it, $YLDY Tokenomics, and How to Maximize Profits on Yieldly, so here we will just talk about what rates can be earned and how risky they are.

The three main ways to earn on Yieldly are through Staking Pools, LP Token pools, and Distribution pools. The first two will use Yieldly’s native token $YLDY, and the distribution pools will use whichever ASAs are currently partnered with Yieldly at the time.

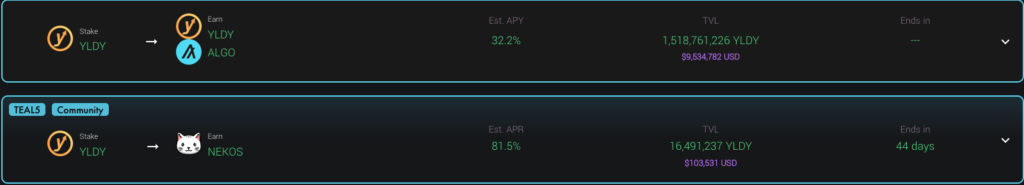

Yieldly’s Staking Pools

Yieldly’s Staking Pools require holding and staking $YLDY for various partnered ASAs or more $YLDY. Pools are TEAL 5 and pay out continuously, so your staked Yieldly is constantly earning whichever asset pool you choose. In order to stake, you must deposit $YLDY into a smart contract which can be withdrawn at any time. Barring an exploit, your staked $YLDY are never at risk.

Rate (APR%): 10 to 25%+. The APR depends on how many total tokens are set to be distributed each day and how many $YLDY tokens are being staked in the same pool. The YLDY -> YLDY/ALGO pool is the most popular and usually sits at an APR of ~20%. Other ASA pools can vary from 10 to 50% depending on the terms of the pool.

Risk Level Compared to Holding $ALGO (1-10): 8. Unfortunately, the risk metric for $YLDY has continued to rise. Yieldly’s prices have fallen strongly from what they once were. The team is hard at work to continue to add utility to Yieldly, but until the $YLDY token sees some price stability and stronger correlation to $ALGO I will have to give it a higher risk mark.

Length of time: 7+ years.4

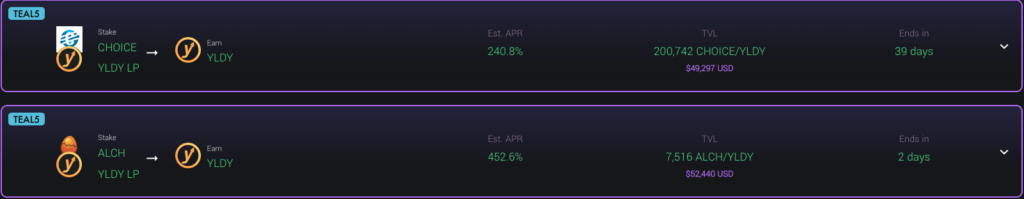

Yieldly’s LP Token Staking Pools

Building on the section about providing liquidity on Tinyman, users are able to stake those Liquidity pool Tokens for additional rewards on Yieldly. These additional rewards are not available for every pool and liquidity pairing, and most pairings take the form of Yieldly/ASA. That said, for the pairings that are available the rewards can be extremely lucrative as the Yieldly you recieve from staking liquidity pool tokens is paid out on top of any fees you earn from being a liquidity provider.

Rate (APR%): 30 to 450%+. Not even including the liquidity provider fees, Yieldly’s pool token staking can easily double or triple the amount one would receive solely from providing liquidity.

Risk Level Compared to Holding $ALGO (1-10): 8.5 to 10. When staking LP pool tokens, you are are double exposed to the risks of holding Yieldly and to whatever ASA you are pairing.

Length of Time: Uncertain, but probably a while.

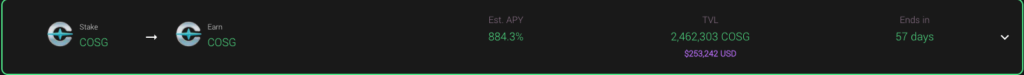

Yieldly’s Distribution Pools

With Yieldly’s Distribution Pools, users are able to stake an ASA and receive more of that ASA. This can be a great way to accumulate more of an ASA that you believe in. That said, buying more of an ASA just so you can stake it is frequently a losing strategy.

Rate (APR%): ~50-800%

Risk Level Compared to Holding $ALGO (1-10): 5+. Entirely dependent on the volatility of the ASA being staked.

Length of Time: Yieldly has made no announcement to stop Distribution pools any time soon.

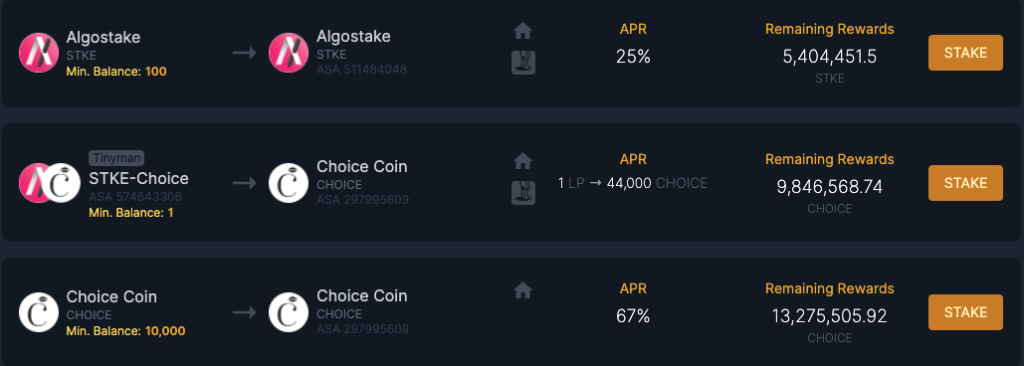

AlgoStake

AlgoStake is a new player on the Algorand blockchain, and competitor to Yieldly’s staking pools. Though less established, the platform has drawn users through offering a wide array of ASAs, some of which are quite obscure. This is because the platform allows projects to set up their own staking pools. With AlgoStake, your tokens never leave your wallet and rewards are paid out through a daily snapshot that checks how much of the staked asset or LP token you are holding. On the flip side, this means there is no audited smart contract that can be seen and you just have to trust the team to continue to pay out.

Rate (APR%): 10 to 100%+. Heavily dependent on the type of pool and the ASA staked.

Risk Level Compared to Holding $ALGO (1-10): 7 to 10. Before investing in any token on AlgoStake, do your own research and be certain it will not be rugged and has potential. AlgoStake does not heavily vet their projects, so don’t get tricked by lucrative rewards. DYOR.

Length of Time: 1 year+

The Algo Faucet

The Algo Faucet is a project that has silently been building for the better part of a year. They offer an entirely free staking service which you do not even need to opt into, their staking service exists solely to facilitate project token staking.

Rate (APR%): 2 to 500%+. The service offers everything from reputable staking projects to completely new memecoins. Do your own research into the project.

Risk Level Compared to Holding $ALGO (1-10): 7 to 10. Similar to AlgoStake, projects are not vetted.

Length of Time: 1 year+

Algofi Lending and Borrowing

Algofi is a protocol for decentralized lending, borrowing and has created an algorithmic stablecoin called $STBL. Algofi plays an integral role in Algorand’s DeFi ecosystem as a decentralized lending platform. There are ways to get creative and risky with leverage and lending, but this article will stick to the basics.

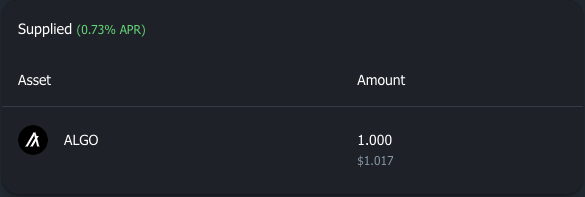

Supplying Algo/Stablecoins/BTC/ETH on Algofi

Supplying Algo is simple and easy. You supply Algo which can be withdrawn at any time in order to increase the amount you can borrow, which can then be staked or used alternatively.

Rate (APR%): ~2-5%

Risk Level Compared to Holding $ALGO (1-10): 1.1

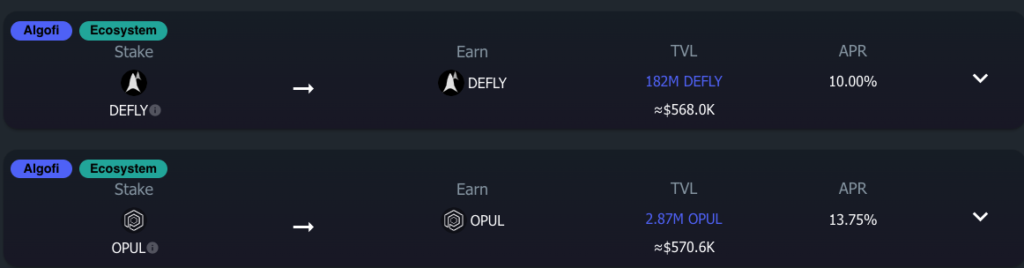

ASA Staking on Algofi

Rate (APR%): ~10%-13%

Risk Level Compared to Holding $ALGO (1-10): Varies, dependent on the ASA.

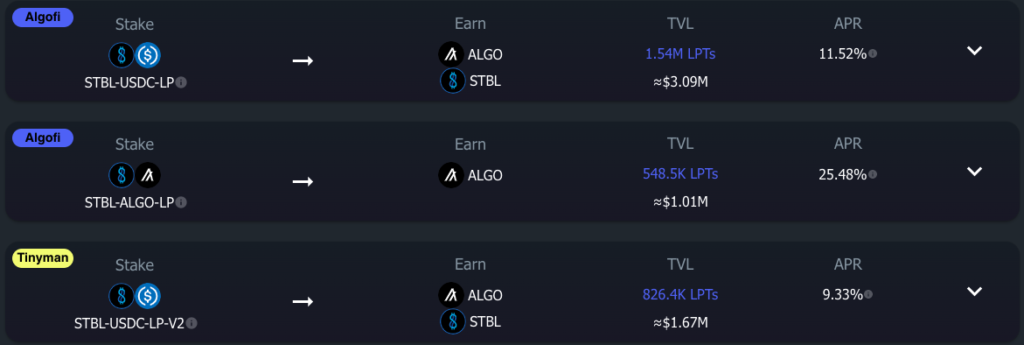

Staking LP Tokens on Algofi

Algofi’s Stablecoin liquidity pairings currently have a great risk to reward ratio, as in theory the price of stablecoin’s should not move. I expect the APR to come down as adoption continues to increase, but for the time being it is a very lucrative option.

Rate (APR%): ~1-56%

Risk Level Compared to Holding $ALGO (1-10): Dependent on pair, stable pairings and algo pairings are lowest risk.

If you want to learn more about Algofi, the AlgoGovClub wrote a very comprehensive article.

Other Ways to Earn

Lofty AI

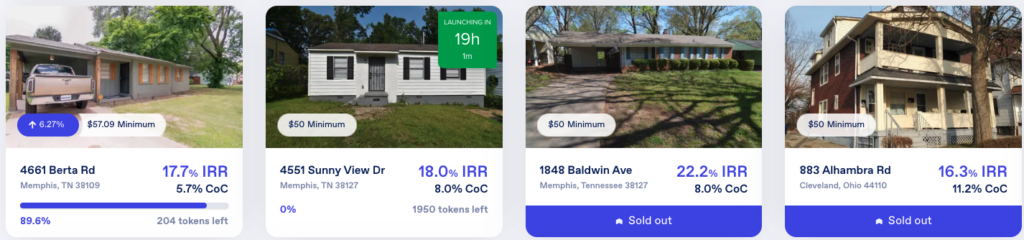

Lofty AI have brought the brilliant concept of tokenized real estate investing to Algorand. With just $50 USD, you can purchase a stake in a private or commercial property, and earn proportional rewards. It’s a truly brilliant concept that already has a diverse host of U.S-based properties available.

The Internal Return Rate of most properties hover between 15 to 20%, and some properties earn rental income which can be withdrawn anytime.

One major roadblock in the way of lofty is regulatory and tax-based, as there are a lot of question marks regarding the jurisdiction of operating in the United States. The forecast isn’t super clear yet, but the concept of tokenized real estate could be revolutionary if they can make it through. All the risks of the real estate market also pertain to Lofty.

Play to Earn Gaming

For this rendition of the passive income guide, I am going to add a few of the major play to earn games currently live on Algorand. While gaming is inherently less passive, there are still aspects that have strong passive earning potential. There are also risk-free ways to get started, which makes me feel they are worth mentioning. Play to Earn games have been the cause of some of my best earnings.

Alchemon

The blue-chip super project of the Algorand ecosystem is Alchemon; an NFT monster-battling trading card game. You can read a more in-depth summary of Alchemon here, so I won’t touch upon its mechanics much. The important thing to know is that each NFT card results in weekly drops of the game’s currency $AlcheCoin. You can then sell this $ALCH for $ALGO or use it to purchase in-game items and cards. Rarer cards result in larger payouts per week. This is the game’s form of passive earning, but also comes with the risk of having to hold Alchemon NFTs.

Weekly $AlcheCoin Strategy:

Risk (subject to market volatility change): High

Payout: High

The second way to earn is through actually playing the game, which only requires 3 basic Alchemon (5A min.) to start. Currently the game is only PvE, but that should change soon. Each victory results in a reward of 2 AlcheCoin (~0.04A), and you can earn up to 250 AlcheCoin (~6A) per day. With enough effort, it is possible to earn back your investment entirely in 3 days.

Active Play Strategy:

Risk: Very Low

Payout: Very Low

The Grocery Store Game

The GSG is a Game that has been around for the better part of the year. It requires zero Algo to start, and can be played entirely free-to-play. Earnings can be low, but it’s a great way to start interacting with the Algorand NFT community without taking on any risk. There is potential for more earnings, but it isn’t something that’ll make a user super rich.

You can read more about the Grocery Store Game here.

Enjoyed Reading? Support the AlgonautBlog

If you enjoyed the piece and want to read more, consider following me on Twitter @algonautblog to stay updated on new posts or supporting the blog.

If you’d like to read about Algorand (without using a single crypto term), click here.

Thanks for reading, and stay safe!