Lofty is Algorand’s most innovative product — a tokenized real estate marketplace, and they’ve just gone one step further with the launch of their AMM. I sat down with Lofty’s CEO & Co-Founder Jerry Chu to understand more about their AMM, and how they’re changing how liquidity works for real estate.

First, let’s start with the problem. Lofty is a marketplace for the exchange of tokenized real estate — $50 shares of properties that make it easier to enter and exit real estate markets. Liquidity is typically difficult to come by when it comes to real estate. Think about how difficult it is to quickly buy and sell a property, and how the profession of realtor exists to close that gap.

Lofty has been successful since launch, but they too faced this liquidity issue: some property shares would sell quickly, while others would take months to find a buyer.

So, they innovated, applying decentralized finance concepts to the real estate market (again!). Their new product allows for the creation of Algorand $USDC and Lofty property token liquidity pools. The end result? Instant liquidity for property traders and higher yield opportunities for $USDC holders.

Lofty’s AMM and how USDC stakers can earn yield

To buy and sell on Lofty, you have to KYC — provide identifying personal information to be regulatory compliant. This makes sense, because you are buying and selling shares of real properties.

Lofty’s AMM launch allows users that don’t want to KYC to get involved, by staking $USDC to a property’s liquidity pool and earning a fee from all sales of that property.

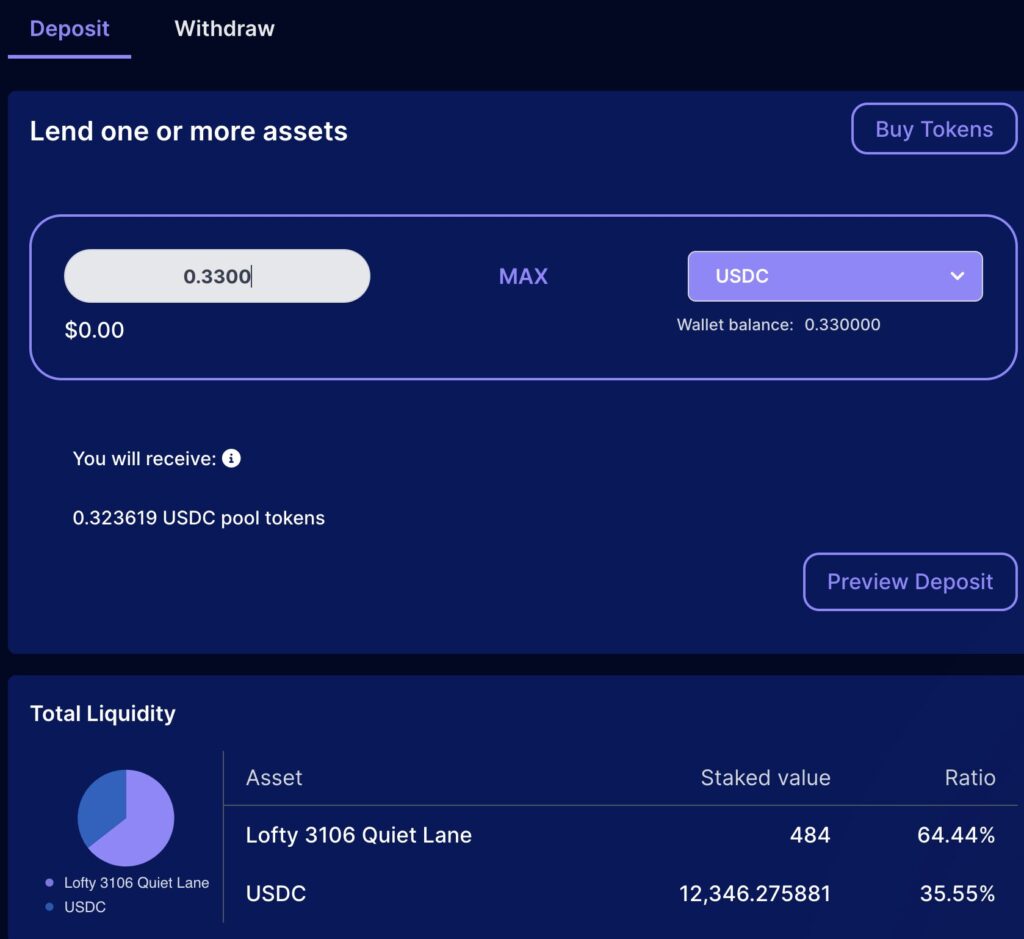

Users can supply either lofty property tokens (in the image, tokens of 3106 Quiet Lane), or they can supply $USDC on Algorand. These go into a pool and the user is given pool tokens. Whenever a user wants to swap from the pool (buying or selling tokens), a 2.5% fee is charged for the transaction. This fee is then paid back into the pool tokens, increasing their value (so long as USDC and the property token remain stable).

The exact APR these pools will yield is uncertain, as the market is still stabilizing, but this is a first-of-its-kind innovation. It solves the liquidity problem for buyers and sellers, and creates a yield farming opportunity for people willing to lend their dollars.

Why Lofty is So Important for Algorand

Lofty is a great product — the team is YCombinator backed and is building on Algorand solely for the technology. Lofty’s goal of real estate disruption is innovative, and could one day bring in millions of users to the Algorand ecosystem. It is a huge use case for Algorand’s blockchain, and could be a catalyst for the conversion of millions of dollars onto the digital world in the form of USDC on Algorand.

Most importantly, Lofty is a real product that is augmented (and not dependent) on the blcokchain. Lofty’s potential goes beyond just Algorand — the real estate market in the United States is valued at over $140 trillion dollars, an insane number. Consider the implications for crypto ecosystems if some of that started to happen on-chain? Lofty’s idea of fractionalized real estate is an amazing one, and could one day have big implications for the real estate market and while lowering the barrier to entry for real estate as a whole. It is the kind of innovation custom-build for crypto, and the type of product we should wholeheartedly support as an ecosystem.

About the Author

Nathan has been running the AlgonautBlog for the last two years. He is focused on creating guides that help people safely the Algorand ecosystem and all it has to offer. He is a Product Manager at Coinbase.