Lofty is one of the most interesting and exciting products in the entire crypto ecosystem. Their main product is a marketplace for buying and selling $50 fractionalized real estate shares— a revolutionary concept that has the potential to refactor real estate markets. I sat down with Lofty’s CEO and co-founder Jerry Chu for an exclusive interview.

We talked about Lofty’s past and present, the constraints they face, their new product, and what they hope to accomplish. We also talked about the crypto ecosystem as a whole and Jerry shared his advice for founders looking to build on the blockchain.

Overall, I came away from the interview feeling grateful that we have founders like Jerry in our ecosystem. He was passionate about his work and did not shy away from answering gray area questions; and he had a realistic, logicial and optimistic outlook towards the future he and his team are trying to build.

On to the interview:

Topics:

Lofty’s Origin | Lofty’s Marketplace Product | Bear Market Constraints | Long Term Success | Lofty’s On/Off Ramp | Tax Implications | Algorand, Crypto, and Jerry’s Advice for Builders

Lofty’s Origin Story

Lofty was founded by cofounders Jerry Chu and Max Ball in May of 2018. They met while working together— Jerry was toying around with a start up pitch desk, and Max asked him what it was about. Within a week they had both quit their jobs and founded Lofty.

Their first product was still Lofty and still real estate, but in a different way. They were trying to use neural networks (a form of machine learning) to sift through unconventional data sources and determine which neighborhoods would have higher than average price appreciation. They sold this as a SaaS product and found some success, but they never saw it getting to a level where the growth would be truly sustainable.

While building Lofty’s first iteration, they started to get the idea that they could do something about the level of access to real estate that people have. Why is it that real estate ownership is such a wealth-blocked form of investment for so much of the population?

Lofty’s Marketplace Product

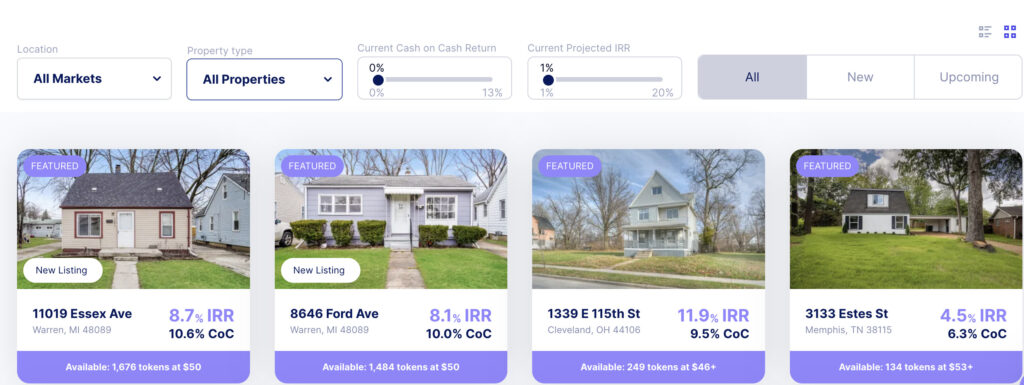

The present day version of Lofty is a real estate marketplace where people can buy and sell tokenized fractions of properties. For as little as $40, you can buy a token of a house or commercial property across the U.S. All the tokens are like owning actual fractions of the property: you receive a proportional amount in rent payments and your tokens appreciate as the value of the property increases.

It is an incredibly interesting idea because it deconstructs the barriers to entry that exist in traditional real estate, namely needing to afford and commit to a very high value investment. Each listing shows the projected return on investment and capital, as well as a price history for the token so you can see how it has changed over time. You are also provided with in-depth details about the listing property and full documentation of location, insurance, occupancy status, and due diligence records.

How are properties listed on Lofty?

Lofty does not buy and sell properties. They are a marketplace, meaning that all the properties listed are put there by individual sellers. Each property goes through a listing and professional evaluation process, and if accepted, gets tokenized and made available for purchase.

Lofty and the Bear Market: Constraints and Success

Anyone that has been following any financial knows that economic conditions are not great right now. Crypto, tech, and real estate are all in various stages of a bear market— and Lofty happens to be at the intersection of all three of those. One of the first questions I asked Jerry was: How is Lofty holding up? What are the current goals?

Jerry was quick to assure me that in terms of capital runway, Lofty is in a great spot. They have more than enough to weather the bear market, and would only see trouble in the case of a very extended economic recession.

The bigger goal, and what Jerry defined as short term success— is driving Lofty towards profitability and ensuring it is a standalone product. Lofty is capital efficient, but not yet profitable. During the bull market run of the last two years, Lofty offered multiple types of incentives to onboard users. They also charged no fees for features that would typically require one.

Those things need to change, and Lofty knows their users won’t love it. Jerry talked about how it was a necessary pain to overcome in order for Lofty to become profitable and sustainable, a decision that will ultimately help secure the long-term success of Lofty.

I appreciated Jerry’s transparency in talking about this topic. It is not easy to basically say: we need to do things that users are not going to love. But Algorand and crypto markets are as low as they have been in years, and it’s unsustainable to operate the same way in 2023 as they did in 2021.

Lofty’s Long Term Vision

Lofty’s concept is one that holds an immense amount of mass market potential. Real estate is an inaccessible investment, and reducing the entry barrier to just $50 is a use-case that could be appreciated by just about every adult.

Lofty’s long term goal is to transform the real estate market. They want to take capital restriction out of the process, and digitalize the property viewing and documentation process.

In the summer of 2019, I was interning at a commercial bank, and I wanted to diversify the sum of earnings I had started to accumulate. I had nearly all of my money into stocks, and wanted to branch out— particularly into real estate. The problem was, there was no feasible way to do so. Actually purchasing a property was too expensive and too much of a commitment, and stock indexes that track the real estate market seemed like a watered down way of investing.

I eventually gave up, and missed the biggest real estate price appreciation California had ever seen in 2020/2021. Lofty’s product is one that can serve the needs of millions of customers globally and internationally. Young professionals can start to index into neighborhoods they like, and grow their wealth in a way that is becoming increasingly inaccessible otherwise, as evidenced by the millennial and gen-Z house-hunting crisis.

Eventually, Jerry hopes people can “say they like a neighborhood, and index into it over time.”

Legal Gray Area and Lofty’s Tax Implications

The crypto ecosystem itself exists in a purely gray area in the eyes of the SEC, and whatever plays out there could end up affecting Lofty in one way or another. Their product itself is as law-compliant as they can be (according to their lawyers). They are a marketplace, and do not invest on behalf of their users. They have never had a token, or anything that could resemble an ICO. On paper, Jerry stated that they are following all the rules, but even so could ultimately end up beholden to the SEC’s whims.

In terms of taxes, it is a similar story. Lofty users are responsible for filing their own taxes, though Lofty provides the forms to be used. If the IRS changes how crypto cost-basis is done, then it could impact the marketplace’s crypto aspect and profitability.

Lofty’s Fiat On/Off Ramp

Jerry shared with me one of the constant struggles that Lofty has faced as a builder in a new ecosystem— much of the infrastructure they need is not yet built, so they have to go and do it themselves. One specific problem is that Lofty users might not be algorand ecosystem users, meaning that the necessity of creating an algorand wallet and using DEXs would be high friction steps for people that just want to purchase real estate tokens.

To this end, Lofty created both their own wallet and a fully functional fiat on and off ramp. This makes it so that users can easily convert between fiat and USDCa without having to have an intermediate understanding of the blockchain. This is an important step that further abstracts away the complexity of the blockchain and makes it more user friendly.

On top of that, the on and off ramp can be used by anyone in the Algorand ecosystem. By creating a product to serve their user’s needs, they also contribute to the ecosystem’s growth because it is a product that anyone can use.

Within one week of beta launch, the on/off ramp has already processed $350,000 in transactions, while collecting a small fee that contributes to lofty’s sustainability.

Algorand, Crypto, and Jerry’s Advice for Builders

My favorite part of the interview was getting to hear Jerry talk about where he thinks the crypto ecosystem is and what it needs to grow in the way we all want it to.

Advice #1: Build products that add value to people’s lives

Builders need to create products that add real value to people’s lives. Focus on real world use cases and value adds, not just investing, speculating and making money. Mass adoption will come when crypto is being utilized in so many ways that it becomes unpopular to vote and create policies against it. Jerry pointed to Uber as a great example of revolutionary technology that became unpopular to vote against.

Advice #2: Advertise a product’s utility, not that it is built on the blockchain

Jerry and I both agreed that the blockchain’s ability to remove the need for an intermediary/middleman is a big value add, but he took it one step further. He says that you should not need to mention that a product is being built using the blockchain, and should emphasize what it improves instead. There are actions that people are doing every day, and blockchain can be utilized to make those faster, cheaper, more accessible, etc. The benefits or value adds are what should be sold— the current focus on marketing the blockchain adds complexity and drives users away.

Advice #3: Focus on consumers, not institutions.

Jerry had a pretty straight forward message for anyone thinking of building on the blockchain: please build for consumers, not for institutions. He stated that institutions are almost always the last ones to adopt, and that they should not be the focus. Perhaps a pretty big takeaway for Algorand and its institution focused model.

Learn More About Algorand

Follow the @algonautblog on twitter.

Keeping up with this blog and reading other articles is a great way to learn about the ecosystem. Here are the most popular articles I’ve written.

- Algorand Explained: Without Using A Single Crypto Term

- The Ultimate Guide to Easing Into the Algorand Ecosystem

- Crypto Wallets on Algorand: Exchange, Self-Custodial and Ledger