What is Pact.Fi?

Pact is a decentralized AMM (automated market maker) built on the Algorand blockchain. It is a protocol which allows users to seamlessly swap between $Algo and other ASAs. It offers deep liquidity and low transaction fees, and allows users to make trustless secure swaps. Their goal is to be the home of liquidity on Algorand, and are building on six key pillars: decentralization, accessibility, immutability, security, and permissionless swaps.1

Pact.Fi in Layman’s terms

Put simply, Pact.Fi will be another place on the Algorand Blockchain where you can swap assets. Others currently include Tinyman, AlgoDex (order book model), and WAGMIswap. Inspired by Ethereum’s uniswap V2 model, Pact.Fi uses a constant product automated market maker architecture. This means that instead of buyers and sellers creating orders and liquidity, it is instead done by liquidity pools backed by decentralized investors pooling two tokens in equal parts. Users are able to swap tokens from these pools, and as risk compensation poolers are rewarded fees and other liquidity pool rewards. Uniquely, Pact.Fi is the only AMM that offers liquidity providers 100% of accumulated liquidity pool fees, which is currently set at 0.3% per swap.2

Pools and funds are locked in inaccessible smart contracts, which means there is no admin control over them. They are immutable, and secured by Algorand’s proof of stake consensus mechanism. On the upside, this is great because it means Pact.Fi can never exercise control over your liquidity pool. On the downside, it means they cannot protect users in the event of a serious exploit like that of Tinyman. This is a major risk that must be accepted when providing liquidity on an AMM.

Swapping, Pooling, and Liquidity on Pact.Fi

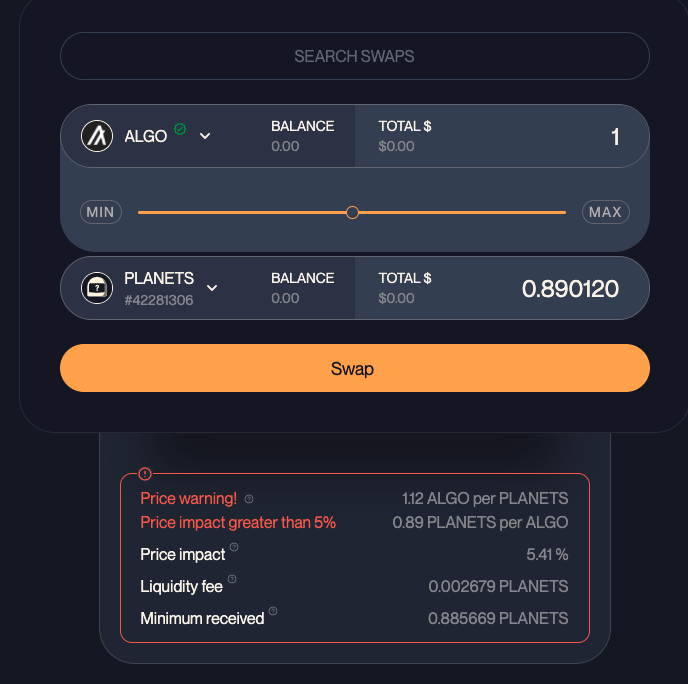

Swapping on Pact.Fi is easy. You select the asset you want to use to swap, and then the ASA you would like to swap to. Pay attention to the price you are getting and the price impact. A high price impact means that your swap will greatly effect the change in token price, meaning that at higher values you may not be getting a great price. The liquidity fee is the cost you are paying to the liquidity poolers to make the swap. Slippage is an adjustable number that you can set to determine what minimum parameter of tokens you would like to receive. If the swap doesn’t fit the parameter, it will reject. You will have to sign the swap transaction with your wallet.

Adding Liquidity to a Pact.Fi Pool

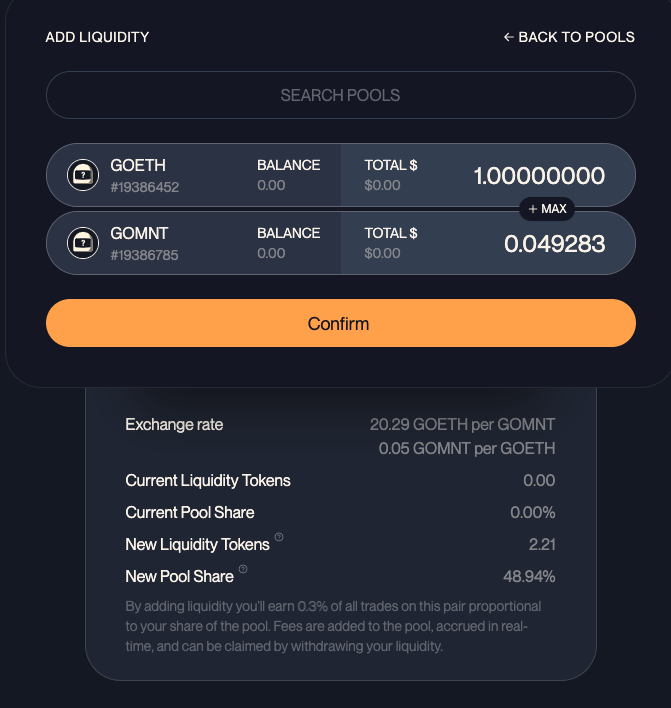

Adding liquidity follows a similar process. You can find the pool you want to add liquidity to under pools, then hit the + button. You will have to provide an equal value of both tokens that you want to pool for. Note: It is extremely unlikely, unless you are doing a STBL-STBL pool, that this ratio will be exactly maintained. The new pool share is the % of the pool that you will be contributing to, which is critical to know when considering how much you will earn in transaction fees, as it is proportional.

Risks of Providing Liquidity on Pact.Fi

Impermanent loss occurs when the ratio of two held assets changes. Impermanent loss is extremely common, and due diligence should be done before investing. It is important to think about whether the rewards for providing liquidity are enough to offset the probability and potential scale of Impermanent Loss. I recommend reading more about it before making your decision if you are new to liquidity providing.

2. Asset Depreciation

Simply put, you are forced to hold two assets for a period of time. One of the two assets is almost guaranteed to be riskier than the other, i.e $YLDY and $ALGO. But you are forced to hold both in equal amounts, even though the risk on both are not the same. Imagine you provide $1000 in liquidity of both $ALGO and $YLDY. A pest disease wipes out all flamingos, and $YLDY crashes making your holdings worth $1. You will not then have $500 in ALGO and $1 in $YLDY. You will have ~$31.62 in both, and an impermanent loss of 93.68% compared to if you just held both assets. So don’t provide liquidity unless you have conviction in both assets.

3. Pool Exploits

Immutable and decentralized also means no safeguarding measures can be enacted for contracts beyond what is built in. Audits by Runtime verification have been done, but there is no such thing as a perfect guarantee of security, as seen by the Tinyman exploit. The potential of a pool exploit is always something that can occur in the world of decentralized finance.

Learn More About Algorand

If you enjoyed the piece and want to read more, consider following me on Twitter @algonautspace to stay updated on new posts or supporting the blog.

If you’re interesting in Passive Income, read the Best Sources of Passive Income on the Algorand Blockchain.

Other recent posts I’ve written include $DEFLY, Algorand’s newest key piece, AKITA INU ALGORAND: The Community’s Token, and What is Headline? Algorand’s Ecosystem Builder.

Thanks for reading, and stay safe!