$YLDY Maximization

Now that you have an idea of what Yieldly is and understand its Tokenomics you probably want to figure out exactly how you can truly maximize your Yieldly rewards. Look no further. In this article, we will cover Liquidity Pool Staking, NFT Prize Games, Optimal Rewards Claiming, and ASA Double Dipping.

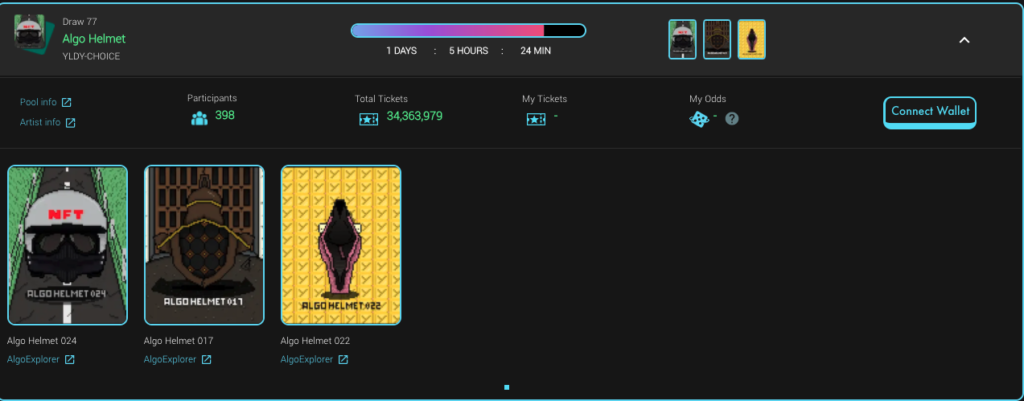

NFT Prize Games

If you’re staking in Yieldly pools, chances are the pool you’re staking in makes you eligible to enter Yieldly’s No-Loss NFT Prize Games. The way it works is that each week, Yieldly has multiple NFT draws similar to their ALGO prize game draws. Each of these draws will be based on a particular pool, in the example below we can see the draw being held in the YLDY-CHOICE pool. There is a 1 to 1 $YLDY to Ticket ratio, so by staking 1 Yieldly in the requisite pool you receive 1 ticket. At the end of the draw period, 1 ticket is randomly selected for each NFT out of the Total Tickets staked. It’s as easy as that. Join a pool, get your tickets, and hope you win. An interview Cassius Cuvee did with Yieldly Founder Seb Quinn confirms that one of the NFTs won sold for over $10,000+ per NFT. Potentially over $100,000 for the the early Yieldlings.

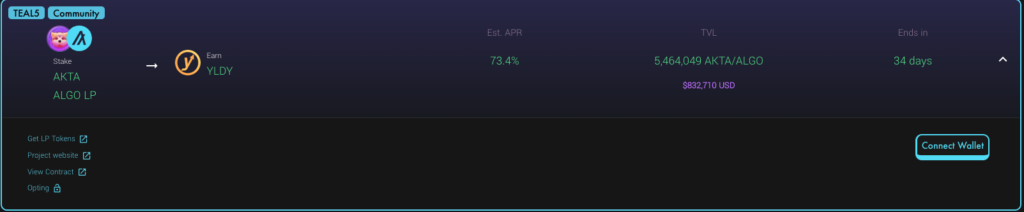

Liquidity Pool Token Staking

Yieldly’s newest and perhaps most exciting launch was Liquidity Pool Token Staking. This article will assume you have a basic understanding of Liquidity pools and how to get LP tokens. For an overview of Liquidity Pools/Tinyman click here. LP Token Staking basically means that you can now earn even more rewards by providing liquidity for the pools with token staking partnerships. Currently, the only pool that has launched is the AKTA/ALGO LP -> YLDY pool but that is expected to change very soon. This pool boasts an Est. APR of 73.4% at the time of this article! Not only will you be earning the not at all insignificant fees from Tinyman, but you’ll be earning YLDY on top of that. Of course, Liquidity Pool providing comes with a lot of risks, so DYOR as always!

Optimal Rewards Claiming Under Teal 3 Programming

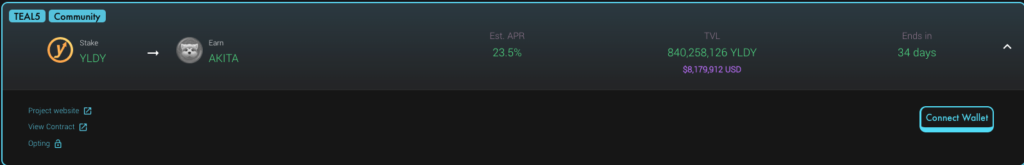

Currently all Staking pools except for YLDY->AKITA have been built using Teal 3 programming. A limitation of this means that your stake cannot be auto compounded and must be manually claimed and restaked. Sounds like a lose-lose right? Not quite. This limitation means that for low APR pools the majority of rewards are paid out at the “snapshot” time, which is about 8:30 PM PST. For this reason, many users choose not to keep their $YLDY staked for the entire duration of the pool. You will notice that as the time approaches ~8:30 PM PST, the APR for many pools drop more and more. This is because people are only adding their Yieldly back into the pool right before the snapshot. For a low APR pool like the YLDY -> YLDY pool, 90% of the days rewards will be paid out at the snapshot and the rest will be funneled out over the next 24 hours. For a higher APR pool, there is more balance and thus more benefit to leaving your stake for the entire 24 hour duration of the pool. No matter the APR however, the most important time to have your stake in a pool is at the snapshot.

Double Dipping for Double Rewards

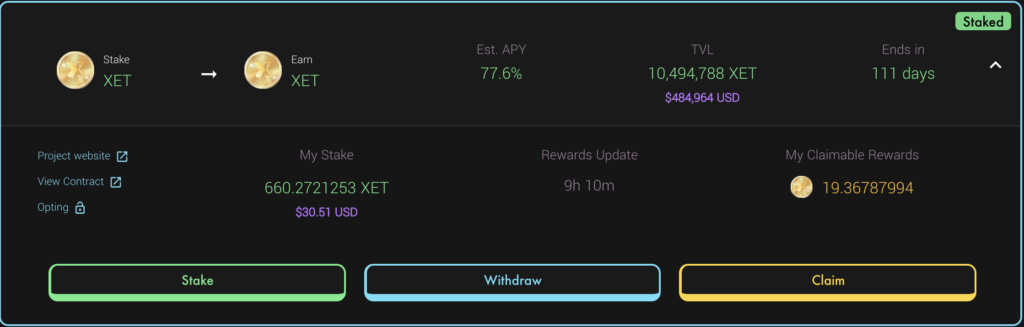

Now that we understand how the snapshot works, we can use this to take advantage of the discrepancies between Teal 3 and Teal 5 contracts. We will use the YLDY -> YLDY (TEAL 3) and YLDY -> AKITA (TEAL 5) pools as an example. The YLDY -> YLDY pool is snapshot staking and the YLDY -> AKITA pool is continuous staking. This means that we can keep our YLDY in the YLDY -> AKITA for 23.5 hours, letting it continue to accumulate continuously. Then, 0.5 hours before the 8 PM PST snapshot, we can swap it back to the YLDY -> YLDY pool for the snapshot rewards. We then switch it back to the YLDY -> AKITA pool for continuous rewards again. Rinse and Repeat. This essentially doubles the amount of rewards you can get per Yieldly, at least until everyone starts doing it and/or Teal 5 contracts are released everywhere.

Found this article helpful and want to read more? Follow @algonautspace on Twitter or Support the Blog!

Disclaimer: None of this is Financial Advice. DYOR!