AlgoStake is a algorand staking protcool where users can stake Algorand ASAs and Liquidity Pools tokens and earn daily rewards. AlgoStake is the main staking protocol on Algorand, and a great way to utilize ASAs. The platform’s native staking token is $STKE (ASA ID: 511484048), but there are also a variety of Liquidity Pool (LP), NFT, and ASA staking options available. This article will contain an overview of AlgoStake, a guide to staking on the platform, as well as AlgoStake’s roadmap and Tokenomics.

New to Algorand? Read Algorand Explained: Without Using Any Crypto Terms.

Stake Algorand Tokens with AlgoStake

AlgoStake’s app allows users to stake algorand tokens through three different pools: $STKE -> ASA, LP Token -> ASA, and ASA -> ASA. Each of these three pools require different tokens to be held in your wallet and pay out various APRs. With staking on AlgoStake, the tokens never leave your wallet. Rather, you must opt into the pool and the AlgoStake protocol will verify how many tokens you have. Then, at a certain point in the day the protocol will take a “snapshot” and distribute rewards accordingly. After that snapshot, users will be able to claim rewards on the app. Staking held tokens for new ASAs is a great way to increase exposure to different projects on the Algorand Ecosystem

AlgoStake Token $STKE -> ASA Pools

These pools involve use of AlgoStake’s Native $STKE token. The most basic one is the $STKE -> $STKE pool, which allows users to receive ~40% APR for holding $STKE in their wallet. Because AlgoStake does not require user’s funds to leave their wallet, it is possible to opt in to multiple AlgoStake pools at once. That said, the other $STKE -> ASA pools all require an AlgoStake Pro membership which is currently $40/year.

Algorand Liquidity Pool Token Staking

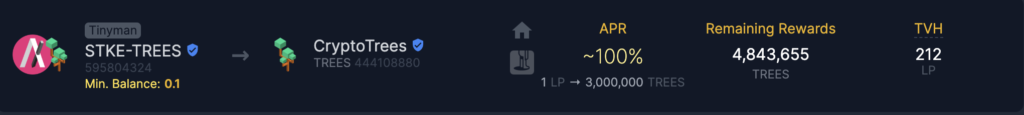

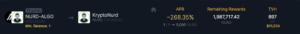

There are currently two types of LP token pools on AlgoStake: ASA/ALGO and ASA/STKE pools. In order to participate in these, you’ll need to stake LP tokens that you receive from providing equal parts of two assets into Liquidity pools on a Decentralized exchange such as Tinyman. LP providing has its risks, most notably impermanent loss, and so deciding to stake LP tokens should not be done without proper research. You can read more about providing liquidity here.

ASA -> ASA Distribution Pools

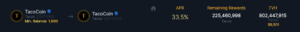

The third type of pool offered are the ASA to ASA Staking pools. This has arguably been AlgoStake’s largest value add to the ecosystem, as they currently have 25+ ASA to ASA pools offered. And since the assets never leave your wallet, you’re able to stake by simply owning ASA and having the minimum balance required.

How to use AlgoStake with Algorand Wallets

Using AlgoStake with algorand wallets is super simple. You can follow these steps to get started with staking.

Step 1: Navigate to the AlgoStake website, then select “Go to App” or click here.

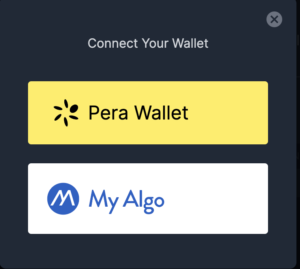

Step 2: Click connect wallet in the top right corner, then select the wallet you would like to use. If using the Official (Pera) wallet, scan the QR code. If using the MyAlgo Wallet, sign in.

Step 3: Select the pool you would like to stake in. Ensure that you have the minimum balance it requires in your wallet. AlgoStake may ask to verify your wallet with a small transaction.

Step 4: Stake and claim your rewards after the daily snapshot. Enable auto-claim if you’ve bought pro features.

It’s as easy as that. If you don’t have the ASA tokens you’d like to stake yet, you can purchase them on a DEX such as Tinyman, Pact.Fi, Algofi or order book AlgoDex.

AlgoStake Roadmap and $STKE Tokenomics

AlgoStake has successfully hit the majority of their 2022 roadmap goals, but have not stated much of what they want to accomplish in 2023 yet.

As mentioned before, AlgoStake’s pro membership is currently sitting at $40/year. It offers automatic claiming of rewards tokens and access to a pro members discord channel, but by far the biggest rewards offered are the ability to “double dip” in all the pools that are pro only. This is because you never have to actually commit the $STKE tokens to a contract to receive a reward, so you can enter in as many pools as you can and receive the rewards for all of them. Most of these pools are pro only however.

Staking NFTs for ASA Tokens

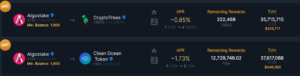

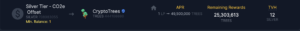

AlgoStake has recently enabled the option to stake NFTs and receive ASA tokens, a feature which is being used by CryptoTrees to reward holders of their Bronze, Silver and Gold offset tokens

$STKE Tokenomics

$STKE (ASA ID: 511484048) has a total supply of 1 billion that have all been minted. According to Tinychart, they have a circulating supply of 10.12% and a price of 1.2 cents, which puts the current market cap at ~$1.25M and the fully diluted market cap at ~$12.37M. The token distribution is as follows, according to AlgoStake’s litepaper.

250 million (25%) will be reserved for liquidity pools, starting with 75 million on Tinyman.

250 million (25%) will be for the AlgoStake team, over a minimum of a 5 year period.

200 million (20%) will be reserved for coin holder staking

100 million (10%) will be for expenses (transaction fees, website, etc)

50 million (5%) will be used for marketing

50 million (5%) will be used for promotions and giveaways

50 million (5%) will be reserved for supporters

About the Author

Nathan has been running the AlgonautBlog for the last two years. He is focused on creating guides that help people safely the Algorand ecosystem and all it has to offer. He was a product manager on the Coinbase Wallet team and a 2021 UC Berkeley Economics graduate.