The Defly Wallet is an algorand wallet with a large amount of features that allows power users to take control of their trading. It is a self-custodial mobile wallet custom made for DeFi by offering top of the line security, DEX swapping, wallet control, and market navigation. Defly is commonly used by algorand ecosystem power users, but provides simple cost-saving features that benefit every algorand holder.

This guide will serve as a comprehensive overview of the Defly product’s features, a breakdown of its tokenomics, and some advice how to make the most of the Defly product.

Table of Contents

Defly Features

– Combo Swaps

– Portfolio Management

– Market Tracking

– Algorand Governance

Creating/Adding a Defly Wallet

– Rekeying an Algorand Wallet on Defly

Security on Defly

– Ledger on Defly

$Defly Tokenomics

Defly App Features

Defly’s selling point is the sheer number of high quality features it offers, it feels like there is something for every user. We will start with the feature that impressed me the most — a cost saving mechanic known as the combo swap.

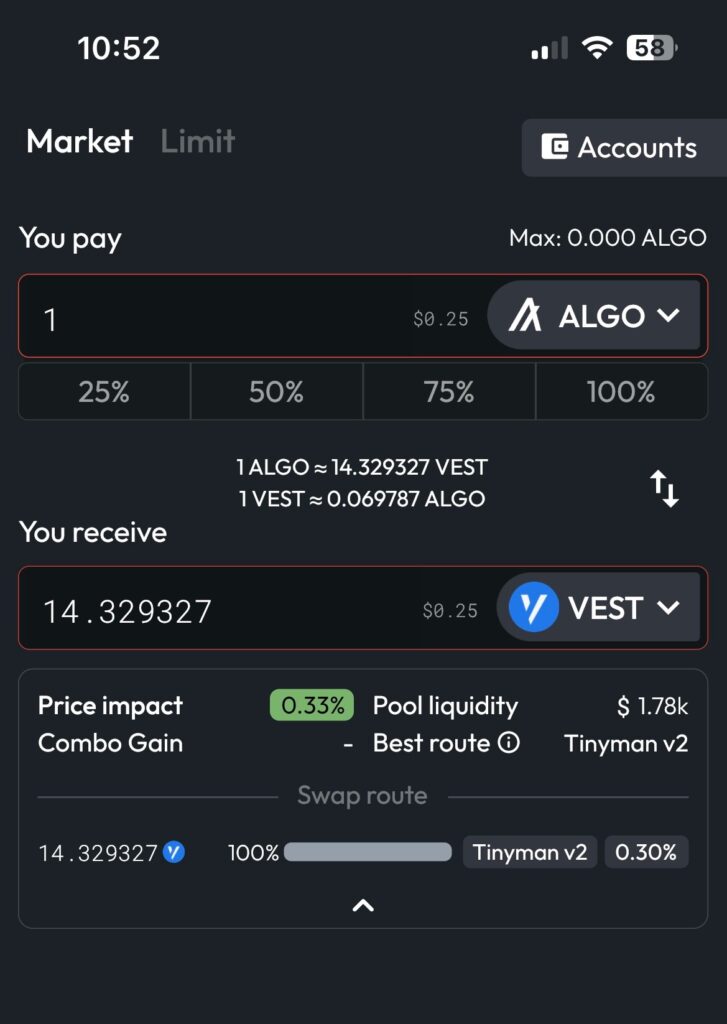

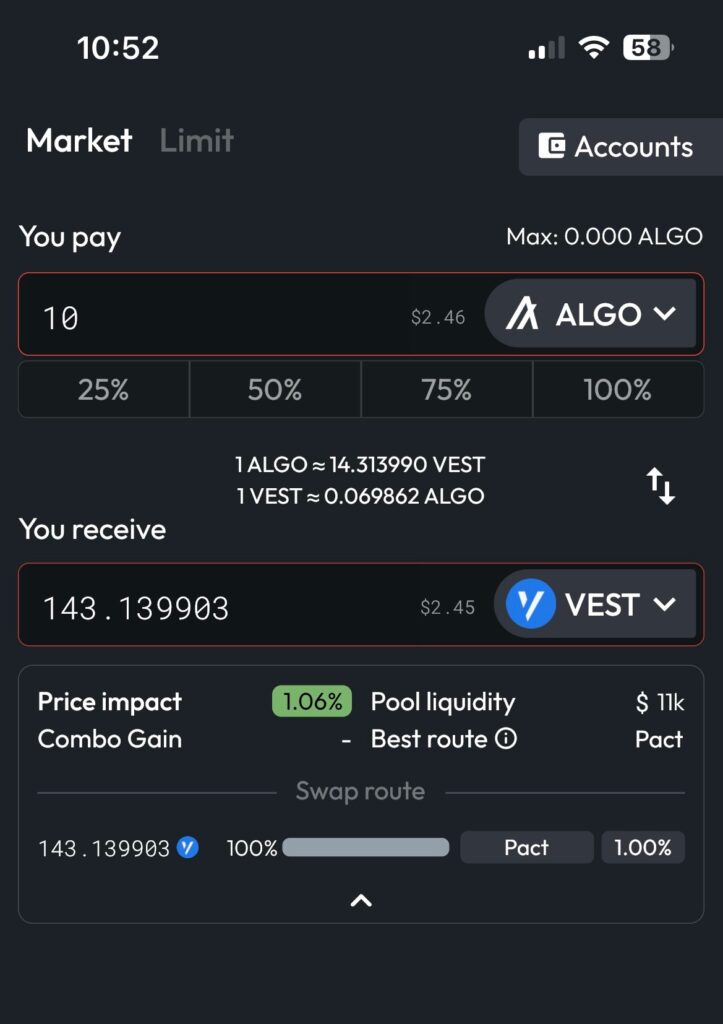

Defly Combo Swaps: Automatically Get the Best Price

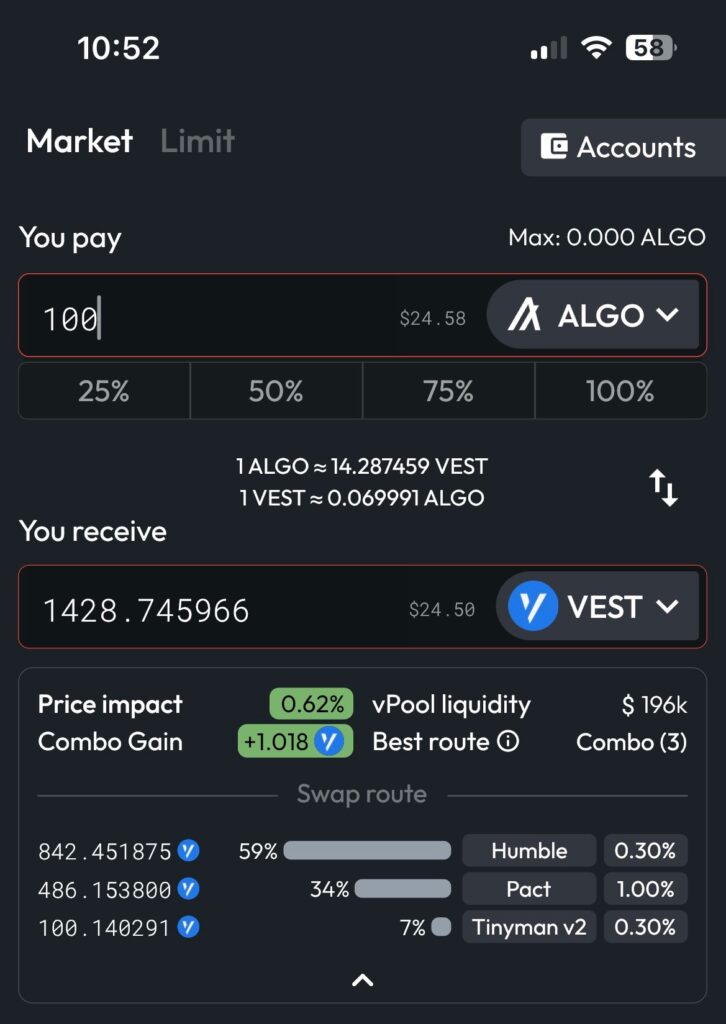

Defly’s swaps ensure that you always get the most value out of your swaps. The app automatically aggregate swap prices across all algorand DEXs and picks the cheapest path. It even considers the individual swap fees and mechanics of each DEX in its calculations. Just using Defly to swap versus any single DEX like tinyman will result in algos saved over time.

Sometimes the most cost-effective swap will require multiple DEXs, a feature Defly calls “combo swaps.” Defly automatically calculates then executes the most efficient swap route for any given trade. This feature alone makes Defly a must use wallet — it will save you value on nearly every single swap. The combo swap feature is often used for higher volume swaps, as it essentially aggregates DEX liquidity and minimizes price impact.

In the example below, we can see how swapping different $ALGO amounts result in different DEX paths. Defly automatically alternates between Tinyman, Pact and HumbleSwap in the example below to get the cheapest price.

Defly’s Advanced Portfolio Management

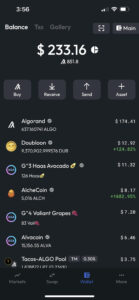

Defly offers the most De-Fi aware way to track your portfolio. It is the only algorand wallet that can track liquidity pools, staking, lending, borrowing, and farming. For any given algorand address you can track all your assets, previous transactions, and even view your NFT gallery.

Address Balance Tracking

The balance tab displays the USD value of all your ASAs. It has send, receive, and add buttons to faciliate movement of algorand assets, and a buy button for direct fiat algo purchases (from Bansa or Transak)

Transaction History on Defly

The defly wallet contains a beautiful interface for tracking everything that you do with your wallet. You can view all previous DEX swaps, limit orders, and recent transactions. This is a particularly neat feature that allows you to easily view all of your account history, and there’s even a CSV export history for all three tabs for algorand transaction tracking and tax purposes.

Defly NFT Gallery

On the gallery page, you can view and search through your wallet’s NFTs. You search quickly by inputting the ASA ID or the NFT’s name.

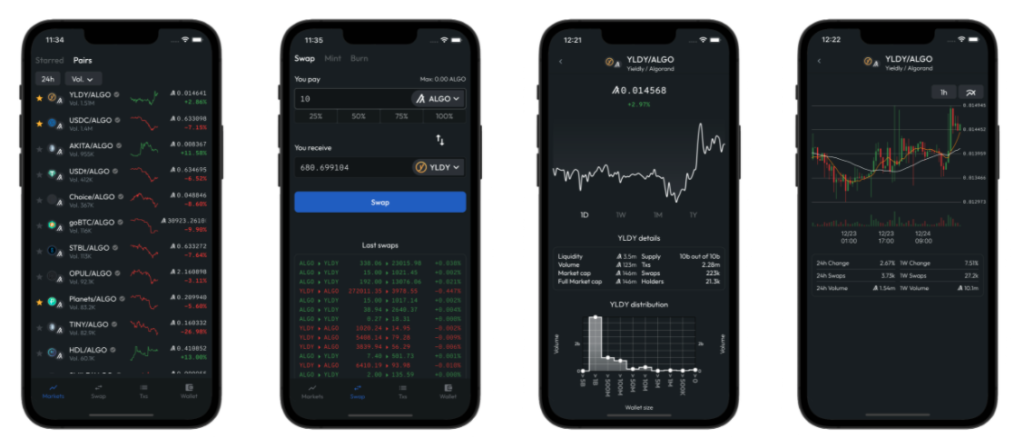

Defly Market Tracking Features: ASA Price Tracking, Token Distribution, and more.

Defly offers advanced market tracking tools for users that want to trade or keep up with algorand market trends. It allows you to track liquidity pool trading pairs and offers various customization settings so that you can obtain the ASA information you are looking for. Below are some of the features of Defly’s markets tab.

Price Charts of Algorand Pairs as a Function of Time

You can view detailed graph of how your favorite algorand tokens are doing over time. In the image above, we are able to track the $DEFLY/ALGO pairing over the past year. If we want, we can get even more specific and view intraday time intervals with live trading candles and 1-minute, 5-minute, 15-minute, and 30-minute charting options. It is one of the best ways to view live changes in ASA prices, similar to what thinkorswim does for stock trading.

ASA Information and Token Details

Defly gives you the tools to track specific information about Algorand Tokens/ASAs. By selecting on a Token/Algo pairing, you can view important information such as liquidity and pool age, to verify that swaps can safely be done. You can also view recent price changes, ASA details, and get information such as the ASA ID, supply, market cap, FDMC, and token distribution. It is a neat view that helps users make more informed decisions.

Tracking Popular Cryptocurrencies on Defly Wallet

Defly does not limit its market tracking features to just Algorand and Algorand tokens. You can also track major Layer 1 blockchains by selecting the algo icon at the top right. You can then view the prices of bitcoin, ethereum, binance, XRP, cardano, solana, polkadot and avalanche from a single tab.

Algorand Governance with Defly

Participating in algorand’s governance protocol is easy with Defly, and you have the option of committing through the official protocol or by using Folks Finance, Algofi, and Gard. You can find the governance tab by navigating to “More” at the bottom right, and then selecting Algorand Governance.

The Defly Manual has a great section on how to commit using all four options, with some step-by-step instructions on how to commit an algo balance to governance.

Note: You can only commit to governance during sign up periods, which will not open until the end of March.

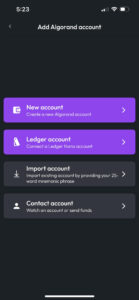

How to Create or Add an Algorand Wallet with Defly

Getting started with defly is a very easy process, and you are able to import algorand wallets that you have created elsewhere, like a Pera or MyAlgo wallet.

After downloading the Defly mobile app, go to the Add Algorand account screen, and select from one of the four options:

New Account: Creates a new algorand wallet.

Import Account: Allows you to safely import a previously created algorand wallet by entering the mnemonic.

Contact Account: Adds a algorand account to be watched (view public transactions) or creates a contact to make sending easier.

Connect a Ledger Nano to Defly: Allows you to connect a Ledger Nano X and use all of Defly’s features in combination with Ledger’s top of the line security.

How to ReKey an Algorand Wallet with Defly

If you are someone who is rekeying their myalgo wallet after the recent exploit, look no further. @GovernorHat wrote a great series of tweets with detailed images on how to rekey with defly, I highly recommend following the guide below.

You can check out the official Defly docs for more information about rekeying.

Why Defly is the Most Secure Algorand Wallet

It is pretty clear that Defly has an incredible feature offering, but some may wonder if that comes at the cost of reduced security. The short answer? No, the defly wallet is very secure.

The long answer: The Defly wallet is self-custodial, which means that you are always in complete control of your private keys/seed phrase. Defly stores your private keys in encrypted local storage, and the only time it is brought into use is when it is needed for confirming a transaction, as is standard practice. Both MyAlgo and Pera operate similarly. Defly’s security does not stop there though: there are additional features such as ledger compatability and cold storage swaps that allow power users to maximize wallet safety.

Ledger on Defly

Ledger hardware wallets are one of the most secure ways to store your crypto. Known as cold storage wallets, the seed phrase for these physical devices never touch the internet, and they serve as 2FA signing devices for a robust level of security.

With Defly’s recent update, ledger users can now access Defly’s features while maintaining ledger’s native protection. It’s a best of both worlds scenario for algorand power users.

Connecting a Ledger Wallet to Defly

Connecting your ledger to defly is easy. You must have a ledger with mobile support (nano X or nano s+ android) as defly is mobile only.

Navigate to the add account screen and select “connect a ledger account.” After doing so you will be prompted to sync up your ledger’s bluetooth. Follow the remaining instructions to pair both devices

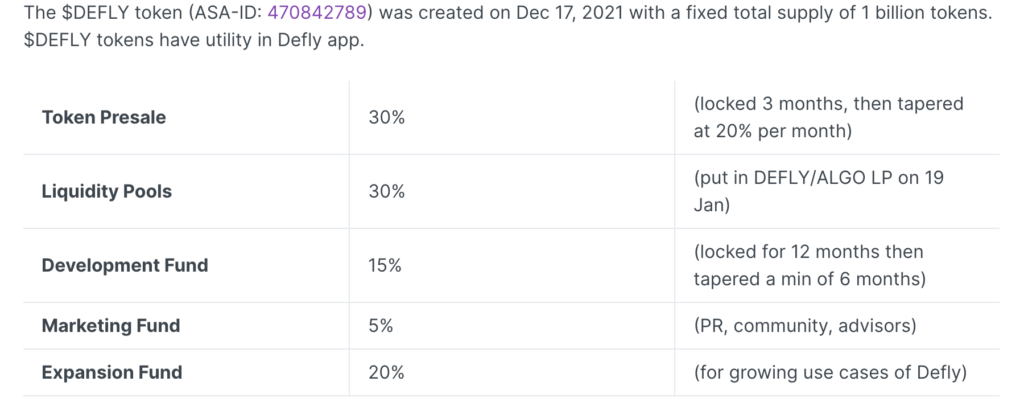

$Defly Tokenomics

$DEFLY is the utility token used for developing the app, expanding the TVL, fees, and rewards. It is used to pay fees and unlock features within the Defly app, which you can read more about here.

For more information, you can read my Defly Tokenomics post, which contains information regarding defly’s price, market cap, circulating supply, presale tokens, dev tokens and more.

List of Recent Defly Improvements

- ARC 35 import/export

- In-App Staking

- WalletConnect V2

Frequently Asked Questions (FAQ)

You can change the default price display by going to the more tab at the bottom right, selecting preferences, general, and then ticking the “display algo in fiat” option. You can change the default fiat currency to euros, pounds, franc, or SGD if you would like.

Find the liquidity pair and click the bell icon at the top right to turn on alerts/notifications. You can manage your price alerts by clicking the more tab and then price alerts.

Yes, defly was unaffected by the MyAlgo exploit. You can rekey a myalgo account to defly using their mobile platform

Learn More About Algorand

Follow the @algonautblog on twitter.

Keeping up with this blog and reading other articles is a great way to learn about the ecosystem. Here are the most popular articles I’ve written.

- Algorand Explained: Without Using A Single Crypto Term

- The Ultimate Guide to Easing Into the Algorand Ecosystem

- Crypto Wallets on Algorand: Exchange, Self-Custodial and Ledger

About the Author

Nathan has been running the AlgonautBlog for the last two years. He is focused on creating guides that help people safely the Algorand ecosystem and all it has to offer. He is a Product Manager at Coinbase.