Yieldly Tokenomics Intro

Once you have a good idea of what Yieldly ($YLDY) is, you should be wondering what $YLDY’s tokenomics look like to get a better idea of its actual value and price potential. (Don’t know what Yieldly is? Click here.) In this post, we will look at YLDY’s market cap, token distribution, vesting schedule, and economics.

Yieldly Market Cap

At the time I’m writing this, Yieldly is sitting at a price of ~$0.018 USD. Over the past three months, it has hit a high of $0.026 USD (2.6 cents), and a low of $0.013 cents1 . These numbers are what everyone looks at initially, but it’s important to understand more than just the price in order to have a more holistic understanding of $YLDY’s price potential.

The Total amount of $YLDY that will ever be available is 10,000,000,000, the same as ALGO’s 10 billion cap. As of Jan 2022, YLDY’s circulating supply is about 4.1 billion, or about 41% its total supply. This is a big thing to realize, YLDY is an inflationary token. This means that over time, more and more tokens will be available to be traded and increase the supply. So if nothing else changes, the price of YLDY will continue to decrease over time. That said, you don’t need a crystal ball to assume that Yieldly has a lot of positive catalysts in its future.

It’s current market cap is ~$44M, but its fully diluted cap is ~$103M. This puts it far below the top DEX’s on other blockchains, but this is something we’ll examine separately in a future post.

If that sounds scary, don’t worry. Most tokens are inflationary, and it’s an important measure to ensure early adopters and whales don’t control the entire supply of a project, an almost guaranteed path to a centralized coin. Now that we understand it’s inflationary, let’s dive a little deeper into the Tokenomics

$YLDY Tokenomics

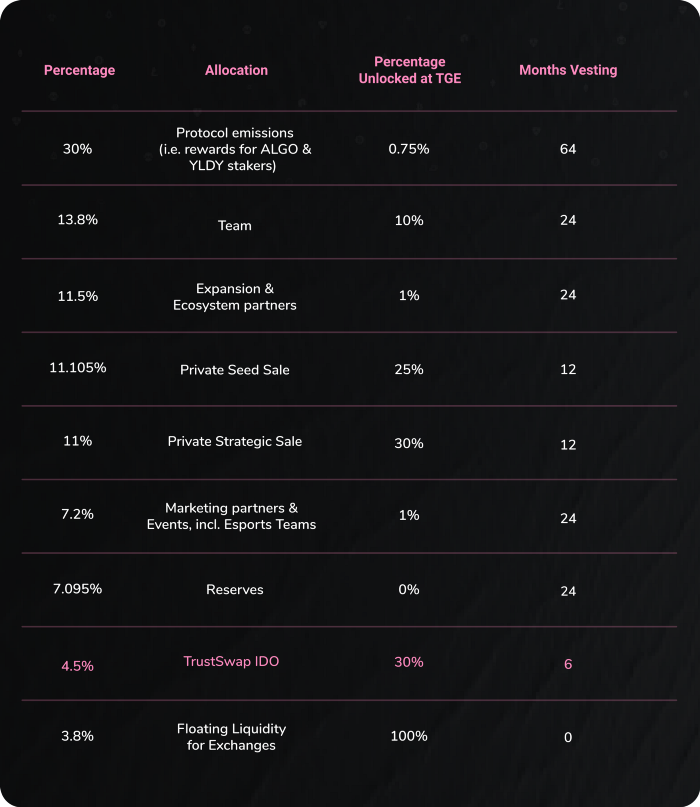

Looking at this image, we can see that of the 10 billion tokens in existence, 3 billion will be used as rewards for ALGO & YLDY staking distribution. This staking will last at least 7 years from launch, or about 6.5 years from now. So there’s no risk of staking rewards running out any time soon!

To me, this distribution looks pretty well thought out. The Yieldly team isn’t small, and it’s constantly growing so it’s understandable that 14% is given there. The 12% dedicated to expansion, 7% to marketing, and 4% to exchange liquidity are great investments that will support Yieldly’s growth. With the recent announcements that bridged YLDY will not be wrapped on the polygon chain, it does beg the question if any ASA $YLDY are being sold to finance Yieldly on different blockchains. Edit: According to Yieldy CEO Sebastian Quinn, they are not financing $YESP or Yieldly Esports using $YLDY treasury.

The other points of concern are the private seed sale and private strategic sale, which had a large portion unlocked and a shortened vesting time of 12 months. This feels like a double edged sword: It’s great because it allowed Yieldly to really hit the ground running and build up investment quick, but 22% seems like a large amount to have sold to private interests and to allow unlocking over a short period of time. While it seems unlikely these private holders and VCs would dump and devalue their own holdings, in the event of a crash and burn scenario we could see a lot of individuals left holding private investors bags.

$YLDY Tokenomics Conclusion

Yieldly is a great project, and I myself am a huge supporter of it. There is immense potential and an extremely exciting future in its roadmap, but there are also limiting factors to keep in mind when looking at $YLDY’s tokenomics. I have faith that the the Yieldly team will continue to successfully navigate their product, but it’s always good to have a broader understanding in mind.