Defly App Introduction

Defly is one of the hottest projects in the Algorand ecosystem right now, and for good reason. Their token sale and public app launch have drawn eyes and downloads from all corners of the DeFi space, and their app is beautifully designed. As with all projects though, any informed investor should learn about the projects Tokenomics in order to make more informed decisions. This article will cover a breakdown of Defly’s price, market cap, circulating supply, and tokenomics.

Defly’s Price, Market Cap and Supply

Defly’s Major Stats: Right now, Defly Token’s price is ~$0.03, and Defly has a total minted supply of 1 billion tokens. Of those 1 billion tokens, only 30% have left the wallet, putting Defly’s circulating supply at 30% or 300 million tokens. This means that Defly is sitting at a circulating supply market cap of $8.8 million, and a fully diluted market cap of $29.4 million. These numbers are constantly changing, and accurate numbers can be checked at tinychart.org.

Defly’s price is a number that should never be looked at without considering circulating supply (how many Defly Tokens are currently available/have left the creator’s wallet) and fully diluted supply (how many will ever exist). For comparison, Defly’s supply is 1/10th that of ALGO and YLDY, and so it would never make sense to compare Algo or YLDY’s prices directly as all else equal, Defly would change in price 10 times faster. A better but still imperfect measure would be to compare market caps.

Defly Tokenomics

Defly Token Presale (30%/300,000,000)

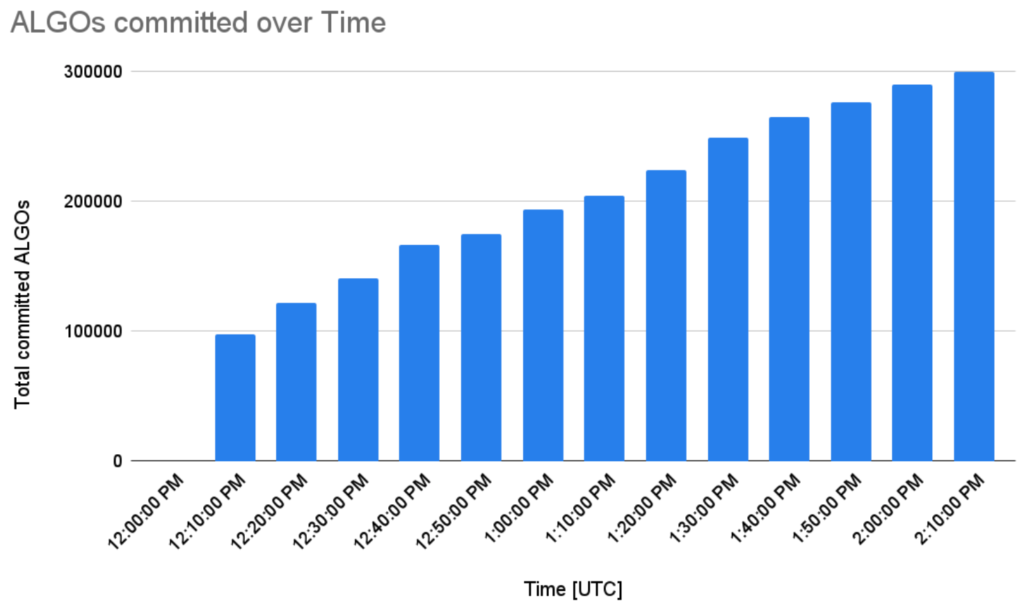

Defly’s Presale went live on Jan 4th, and was fully sold out in two hours. The 30% of tokens available were sold at a flat rate of 0.001 Algo each, for a total cap of 300,000 Algo. Once this cap was reached, the presale ended.

Importantly, this means that there are 300,000,000 tokens that are waiting to be unlocked. These tokens will be unlocked 3 months after the presale, and will be tapered at a rate of 20% per month1 . In other words, starting in the first week of April the first presale tokens will be able to be used, which means that 60,000,000 tokens or 6% of the total supply will be added, bringing the circulating supply to 36%. These presale tokens will continue to unlock for 5 months, until the 30% of presale tokens are fully unlocked, and the circulating supply is ~60% (could be more depending on other tokenomics factors)

Does this mean Defly’s price is guaranteed to crash? No. A 6% unlock does not mean 6% are sold. In fact, presale investors may be more dedicated than the average investor and be less likely to sell their tokens. Also, if the Defly team continues to add value to their project, the growth rate could easily surpass the current dilution rate.

Liquidity (30%/300,000,000)

Defly’s liquidity tokens are the current 30% circulating supply you see right now. It was an equal match with presale ALGO, and it was added to DEX trading pairs.2 Defly currently has the second most liquidity locked on Tinyman, behind only the USDC/ALGO pair and ahead of the STBL/USDC pair.3

Defly Development Fund (15%, 150,000,000)

Similar to the presale tokens, the Defly Developer tokens will be locked for a period of 1 year, and then will be tapered a minimum of 6 months. More information on specifics to come.

Defly Marketing Fund (5%, 50,000,000)

This portion of Defly tokens will be dedicated to supporting the project’s growth through the following avenues: initial growth and advisors, social media warriors, brand ambassadors, and design work and identity.4 As far as I can see, these tokens are not locked, but have not left the developer wallet which still shows 700,000,000 DEFLY.5

Defly Ecosystem Expansion (20%, 200,000,000)

The 20% ecosystem expansion tokens are to be used for strategic growth, some examples listed are: general DEFI integration development, swap protocol interfacing, cross-chain bridge integration, additional liquidity pools, LP incentives/rewards, general TradFi integration, tax/legal compliance, third party allocation/equity vesting.6 These tokens are also currently in the developer wallet.

Defly Tokenomics Conclusion

As with any token, there are going to be dilution events to watch out for. The biggest two right now are the PreSale and Dev Fund unlocks, which have potential to add varying amounts of downward price pressure when they do happen. Personally, I like that Defly did a public token sale on a first come first serve basis. Many projects choose to go the VC or Private Seed Sale route, which can be more profitable for the project in the short run but can lead to centralized token holders that are more interested in profits than project success or ecosystem integration.

Enjoyed Reading? Support AlgonautBlog

If you enjoyed the piece and want to read more, consider following me on Twitter @algonautspace to stay updated on new posts or supporting the blog.

Other recent posts I’ve written include $DEFLY, Algorand’s newest key piece, AKITA INU ALGORAND: The Community’s Token, and What is Headline? Algorand’s Ecosystem Builder