Maximizing Algorand staking APR/APY and earning more $ALGO is important to any Algorand owner, but it can be difficult to decide where to stake your Algorand. This guide will help you determine where to stake your ALGO to maximize your earnings.

There are four main ways to earn with your $ALGO. Click on the links below to learn more.

1. Staking on Exchanges (low effort, low earn)

2. Liquid Staking with Messina.One (moderate effort, high reward) — currently nearly 24% APY

3. Governance (moderate effort, moderate to high reward)

4. Algorand DeFi Staking (moderate effort, high reward, very high risk)

Note: New to Algorand? Start here.

Staking $ALGO on Crypto Exchanges

Earning Algorand on Crypto exchanges is the easiest way to stake and still results in a decent APR and rewards percentage. By staking on an exchange, you allow the exchange to participate in Algorand’s Governance Protocol on your behalf, but they take a sizeable chunk of the governance rewards for doing so.

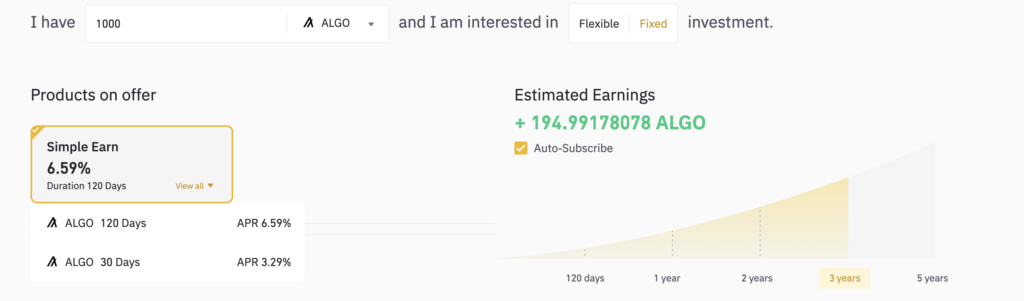

Binance Algorand Staking APR/APY: 6.59%

Effort: Very Low

Binance $ALGO Rewards APR: The APR for staking on Binance Earn is 1.54% to 5.1% depending on staking duration.

Notes: Binance is the largest crypto exchange, but is less trusted than Coinbase and other U.S based exchanges. If you hold $ALGO on Binance, it may be worth exploring self-custody wallets where you can both own your crypto and earn higher Algorand APR.

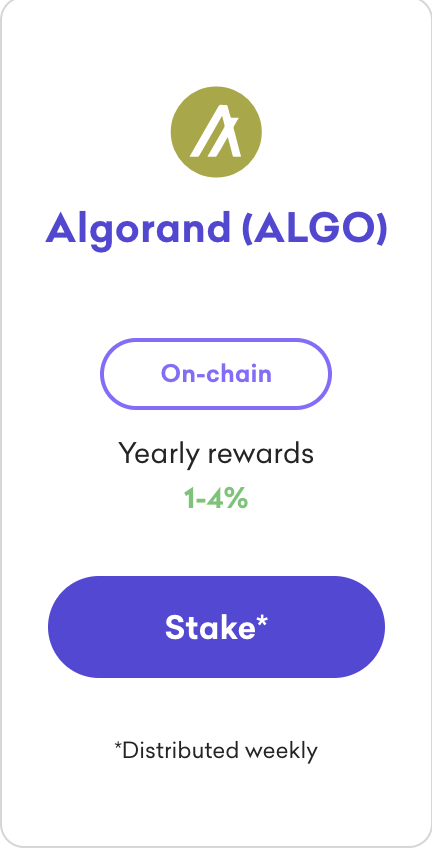

Kraken Algorand Staking APR: 1~4%

Effort: Very Low

Kraken $ALGO Reward APR: Kraken’s Staking APR is between 1 and 4%, paid out weekly.

Notes: Kraken is a trusted U.S crypto exchange.

Effort: Very Low

Coinbase $ALGO Rewards APR: The APR for staking on Coinbase is currently 6.52%. They estimate it to be ~5.75% annually. Rewards are paid out quarterly.

Notes: Coinbase is a trusted U.S exchange that holds customer assets 1:1, but is still not self-custody. There are ways to easily earn higher algorand wallet staking rewards, but this is not a bad option for beginners.

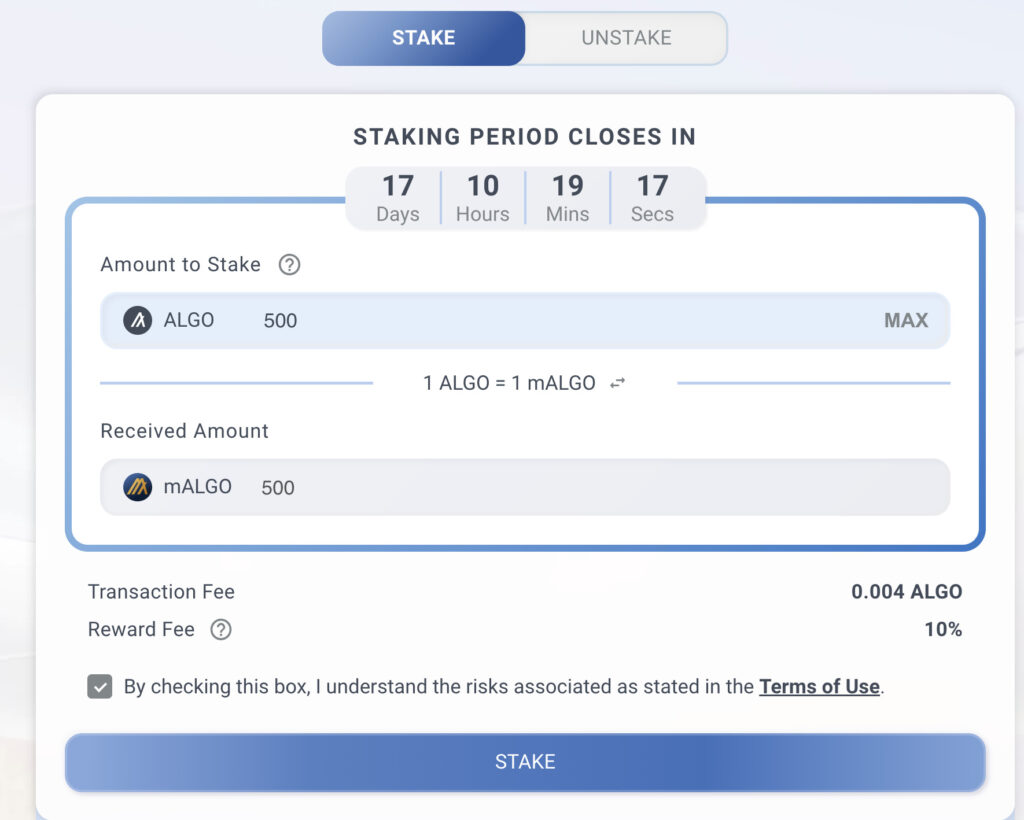

Liquid Staking with Messina.One

This September, Messina.one launched mALGO, a liquid staking product that accepts $ALGO and accrues governance rewards over time. This adds a liquid staking option back to Algorand, making it so that you can earn the rewards of governance while having the flexibility of using your funds in the Algorand ecosystem.

How Does Liquid Staking on Messina.one work?

The idea is that the value of $mALGO, which is initially pegged 1 to 1, will continue to increase over time as it accrues governance rewards.

You can stake your $ALGO before the start of each staking period. You can unstake your $ALGO at any time, including during governance periods, with the exchange rate being whatever the $ALGO <> $mALGO liquid pool sets. Locked tokens are automatically re-staked, making it less painful to manage and vote.

Effort: Low

mAlgo Reward APR: ~24% for Q4 2023. Currently Very High, due to a boost.

Notes: Take advantage of the messina.one staking boost while it exists.

Stake USDC on Lofty’s AMM

Source: Lofty.AI on Twitter

Lofty.AI recently launched the ability to stake USDC in liquidity pools without the need to KYC. In exchange for depositing USDC, you will receive liquidity pool tokens of a pairing between USDC and the selected real estate property. These pairings will return value the more frequently the Property <> USDC pairing is traded. The more swaps happen, the more fees are generated, and the more APY is returned to pool tokens.

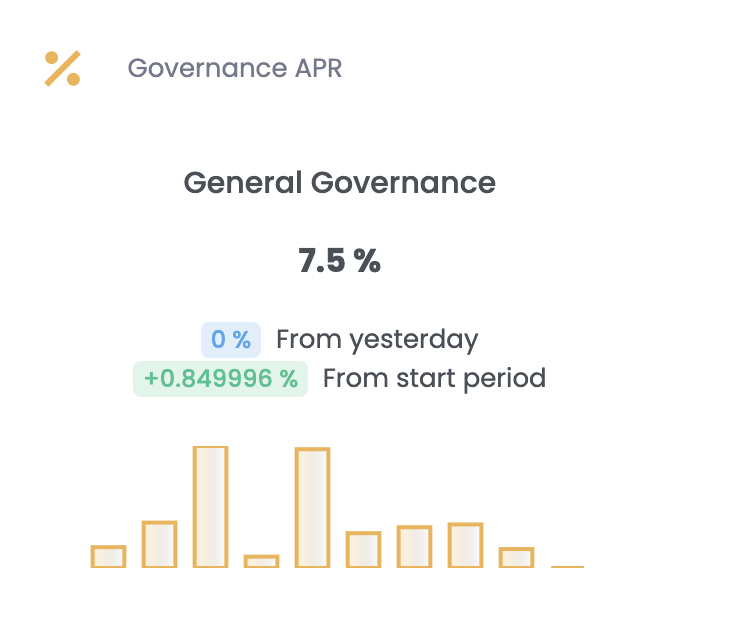

Maximize $ALGO Staking Reward APR through Governance

Participating in Algorand Governance through a self custody wallet is a great way to increase rewards earnings while participating in the ecosystem, and it is not very hard to do.

Effort: Low

Algorand Governance APR: 5.6% (Governance) and 9.77% (DeFi Governance) for Period 6 in 2023. Likely to be in a similar range for Period 7.

Notes: Governance is a self-custodial process, meaning you are in complete control of your $ALGO and Algorand Wallet keys at all times.

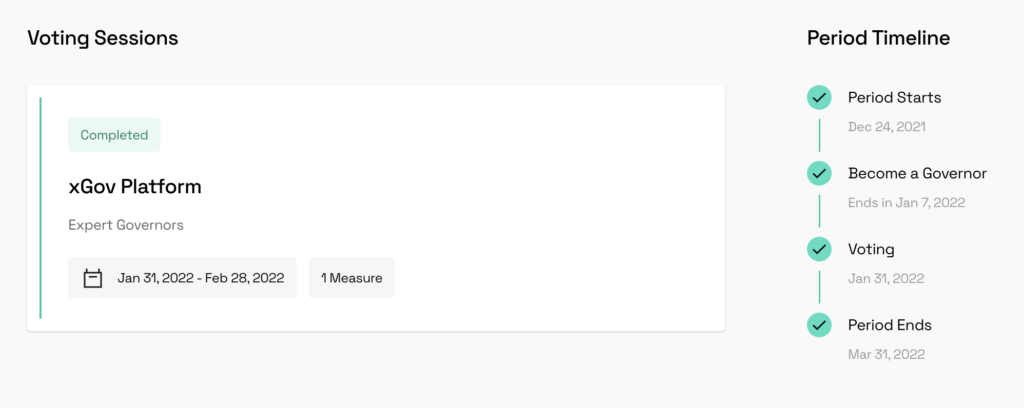

Participating in Algorand Governance is a simple process through which you connect an Algorand Wallet and commit a minimum balance for a duration of a couple months. In order to remain eligible for the reward at the end of the quarterly period, you must maintain the committed balance of $ALGO and you must vote in all of the governance proposals within the timeframe.

Link to Sign up for Governance

How to Earn Algorand APR in Governance

To participate in Governance, you must move your algo off an exchange and onto a self-custodial hot wallet. Popular choices in the Algorand include Defly and Pera Wallet. You can follow my guide for a short primer on how to move algo off an exchange.

Participating in Algorand Governance

Once you have $ALGO in an Algorand Hot Wallet or Ledger, participating in governance is very easy. You can follow the Algorand Foundation’s official guide to governance, which is very easy to follow.

A few things you need to keep in mind for governance:

- If your wallet balance dips below your committed amount, you will be ineligible for that period’s governance rewards. Keep an eye on it! Some people recommend a separate wallet for governance to make sure this does not happen.

- You must vote in the governance session measures within the two week voting period. This is easy to do but important to keep an eye on. You can see the voting schedule here.

And that’s all! Participating in Algorand Governance takes an active action towards improving the Algorand Ecosystem. Win-win!

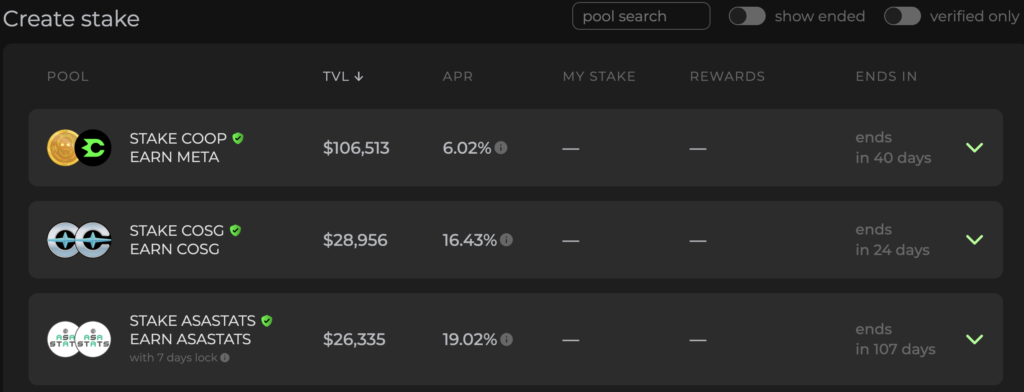

Algorand Staking on Cometa

Cometa is an Algorand staking platform where you can stake algorand ASAs and liquidity pool tokens for rewards. In the example above, you can stake the $COOP coin ASA for $META at a rate of ~6% APR. With Cometa staking, your algorand tokens are held in custody by the platform — though you can unstake at any time. The risk you take on when staking with Cometa is that the tokens you hold might change in price, causing you to lose value even if the number of tokens you own increases.

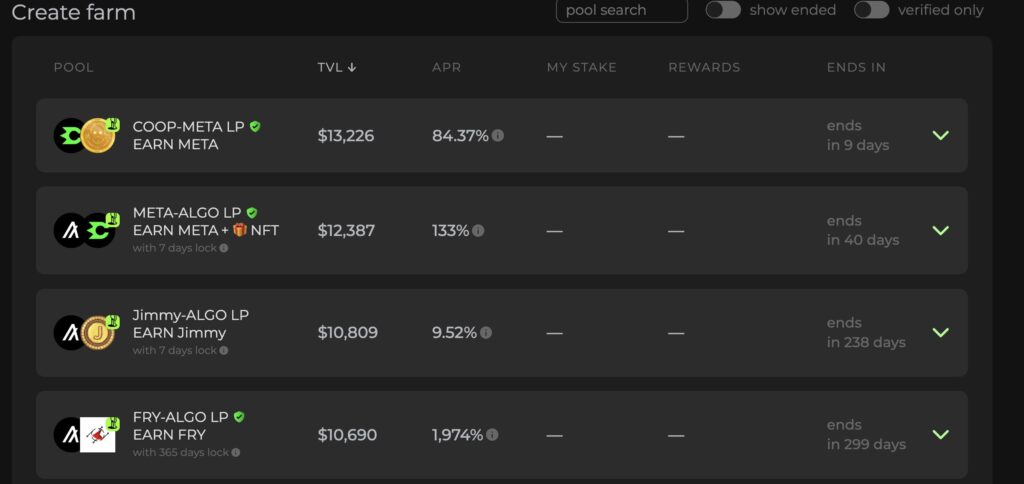

Cometa Algorand Farms

Cometa’s “Farms” are another way to put your liquidity pool tokens to work. Farms work similarly to staking in that they pay out apr rewards for locking up algorand tokens, but they are specific to liquidity pool pairings. Be very wary of the ridiculous APRs these farms display — it is because the tokens are extremely volatile.

Algorand Staking FAQ

No, as of 2023 you can no longer stake Algorand on Coinbase.

No, Algorand does not reward validators. Algorand rewards participants via a governance model that pays out quarterly.

Learn More About Algorand

Follow the @algonautblog on twitter.

Keeping up with this blog and reading other articles is a great way to learn about the ecosystem. Here are the most popular articles I’ve written.

- Algorand Explained: Without Using A Single Crypto Term

- The Ultimate Guide to Easing Into the Algorand Ecosystem

- Crypto Wallets on Algorand: Exchange, Self-Custodial and Ledger

About the Author

Nathan has been running the AlgonautBlog for the last two years. He is focused on creating guides that help people safely the Algorand ecosystem and all it has to offer. He is a Product Manager at Coinbase.