What is AlgoDex?

AlgoDex is a highly decentralized marketplace built on the Algorand Blockchain with advanced order book functionality. It is a peer to peer marketplace that allows users to trade ASAs and non-fungible tokens (NFTs). It is unique because it is the second ever DEX on the Algorand Blockchain and it uses an order book model which allows users to trade at prices they select (limit orders).

This article will explain the use cases and need for AlgoDex, provide information about what tools are available, cover $ALGX Tokenomics and more.

Table of Contents

AlgoDex Use Cases & Niche

AlgoDex Fees

AlgoDex Liquidity Providing

$ALGX Tokenomics

AlgoDex Mailbox

Yieldly Partnership and Staking

Support the Blog

AlgoDex Use Cases and Niche

AlgoDex is not the first Decentralized Exchange (DEX) on Algorand, that honor goes to Tinyman. But as proven by the Tinyman exploit that occurred at the start of this year, one DEX is not enough. Competition is vital in a successful ecosystem, and AlgoDex brings to table a couple of unique elements that make it so exciting.

AlgoDex Market and Limit Orders

Market and Limit orders are extremely convenient and useful tools to have for both users and order books. From a user perspective, investors often have a target price in which they would like to buy and sell at. This price is often passed quickly and momentarily, which means that not only does a user have to be present to execute their order, but they have to get “lucky” in the sense that even if they attempt to buy/sell at a certain price, there also has to be enough demand/supply at that same price. A user who buys at a market price will get something around the target price, a user who uses limit orders will always execute at that price or better.

From an order book perspective, limit orders add liquidity to a market, which is vitally important in growing Decentralized Ecosystems. This is because the money is held until the order is executed or canceled.

AlgoDex uses Algorand’s Smart Contracts and their escrow* function to create a buy/sell order on behalf of a user. These orders are compiled into a ledger book. When the price is equal or better than the price in the user’s contract, it executes and the funds are moved out of escrow. A more indepth explanation of Order Books can be found on AlgoDex’s whitepaper.

*Escrow means a neutral place in which parties can deposit money or items.

Important Update: Trading of Stablecoins, $goBTC, $goETH, $STBL and NFTs was enabled for North American users on May 28th.

AlgoDex Fees

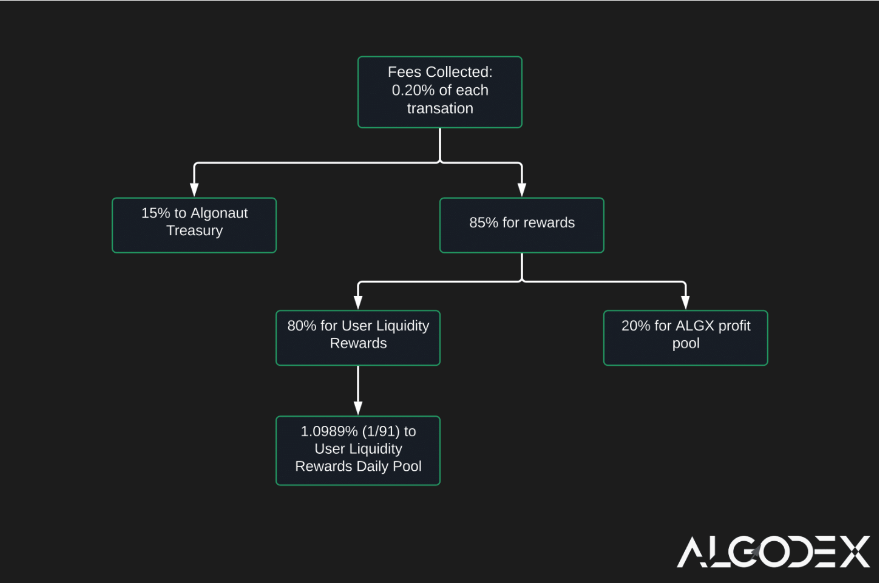

AlgoDex will have the basic Algorand fees of 0.001 $ALGO per transaction. Upon AlgoDex’s second mainnet launch, they will implement trading fees and a user rewards system. Those fees are expected to be 0.2% of each trade. Currently, there are no trading fees beyond the basic Algorand fee.

AlgoDex Liquidity Providing

Liquidity on an order book is based on the depth of the order book and the amount of funds in each order. Open orders build liquidity on AlgoDex. In order to promote this, incentives including airdrops and a future rewards system will be implemented.1

Before fees are implemented with the second mainnet launch, liquidity rewards will be paid out in $ALGX. Afterwards, the rewards will be paid in ALGOs. Calculation for reward fees will be the same during both periods. The reward will be based on the quality of liquidity provided, which is determined by the length of time, closeness to the bid/ask, and quantity of liquidity provided.

A more indepth explanation of AlgoDex’s reward calculation methodology can be read about in AlgoDex’s whitepaper.

$ALGX Tokenomics

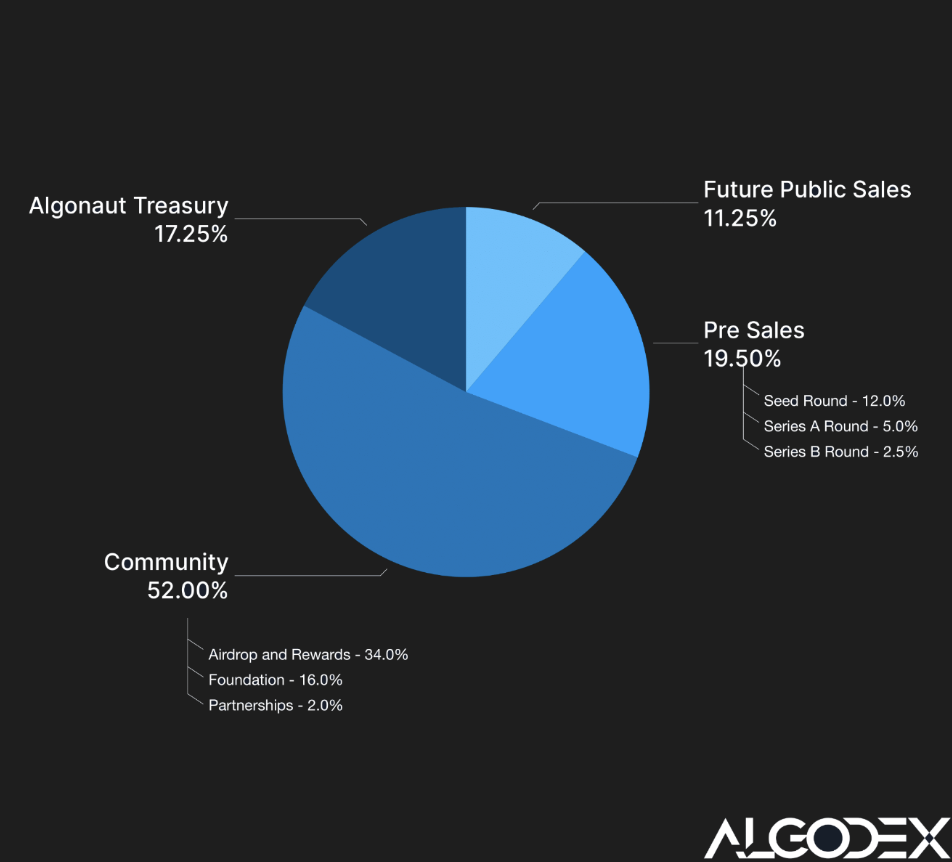

Algodex’s token $ALGX (ASA ID: 724480511) launched on May 31st, and serves as the protocol’s governance token via the use of a decentralized autonomous organization (DAO). Token votes will be proportional to held $ALGX.

$ALGX is currently listed on multiple Algorand decentralized exchanges and centralized exchange bitmart. You can obtain $ALGX on Tinyman, PactFi, Algodex, Algotrade, and Bitmart.

As delineated by the whitepaper, most of the tokens are split between community use, private funding, and treasury purposes of Algonaut Capital, the corporation backing AlgoDex after the acquisition of Algodev. Whether or not these Tokenomics provide ample room for investing success remains to be evaluated as more information about $ALGX is revealed.

AlgoDex Yieldly Partnership

AlgoDex and Yieldly have partnered to launch three new token staking pools on the Yieldly platform. Though specifics haven’t been released, it’s likely that there will be one staking pool, one liquidity pool, and one distribution pool.

Staking Pool: Stake $YLDY -> Receive $ALGX

Distribution Pool: Stake $ALGX -> Earn $ALGX

Liquidity Pool: Stake $YLDY/$ALGX Liquidity Pool Tokens -> Earn $YLDY

You can read more about Yieldly and how to participate in pool staking here.

AlgoDex Mailbox

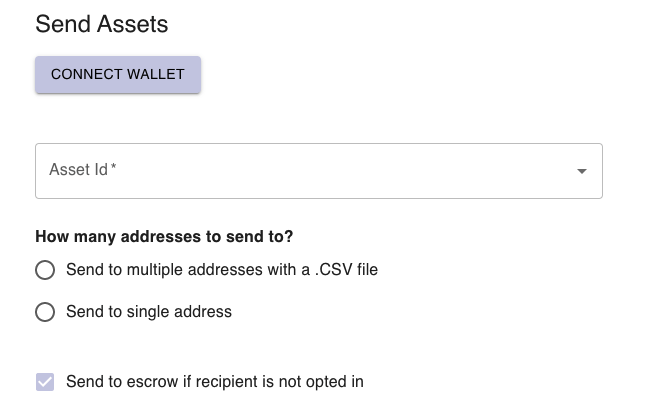

AlgoDex Mailbox is a token management DApp that allows a user to batch send Algorand Assets to recipients, regardless of whether or not they are opted in. If the recipients are opted in, the app directly sends the assets. If they are not, then it holds the asset in an escrow wallet until the recipients are able to opt-in and recieve them. There’s also a “return to sender” function from the escrow wallet. This is a pretty unique innovation that circumvents how difficult it can be to send out rewards or assets to wallets that aren’t opted in.

Additional Information about AlgoDex & Ongoing Developments

Read AlgoDex’s documentation for an indepth example based guide on how to trade on AlgoDex’s mainnet.

AlgoDex dApp for order cancellation. In order to prevent users from being Robinhooded when the Algodex website is down, the team built a second dApp for order cancellations. A great touch.

AlgoDex recently announced that they have open sourced their JavaScript SDK (Software Development Toolkit). You can see more on their Github or on their website’s documentation.

AlgoDex is working on a market maker bot to add liquidity and arbitrage in order to deal with some of the liquidity issues the platform currently has. They hope to release this soon!

The AlgoDex team has added the ability to place a bid/ask for any NFT as an ASA.

Pera Wallet integration is coming soon.

Support the Blog & Important AlgoDex Links

AlgoDex Discord: http://discord.gg/qS3Q7AqwF6

AlgoDex Telegram: http://t.me/algodex

AlgoDex Twitter: https://twitter.com/AlgodexOfficial

Keeping up with this blog and reading other articles is a great way to learn about the ecosystem. Beyond that, here are some other amazing resources that share Algorand information and News:

If you enjoyed the piece and want to read more, consider following me on Twitter @algonautspace to stay updated on new posts or supporting the blog.

If you’re interesting in Passive Income, read the Best Sources of Passive Income on the Algorand Blockchain.

Thanks for reading, and stay safe!